More evidence that the US economy is slip-sliding into recession. Lower consumer spending and lower GDP growth will soon cause the Fed and governments to act.

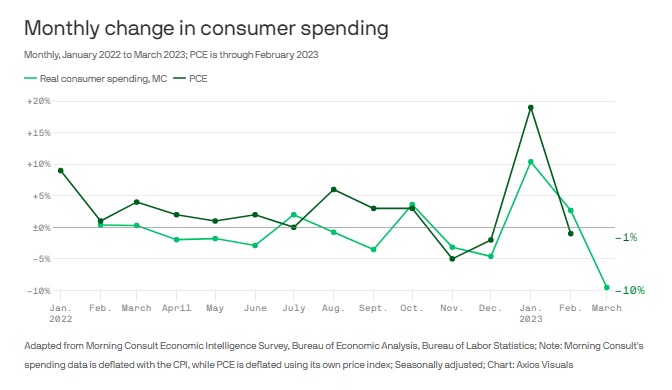

Consumer spending fell substantially in March from the previous month, according to a survey out Wednesday from Morning Consult. The American consumer is running out of gas when it comes to shopping — across all categories, from food to travel — as inflation continues to pinch and fears of job losses among higher-wage earners grow. It’s a sign that the economy is cooling down a bit from the red-hot spending of the pandemic era. See this in the chart below and learn more here.

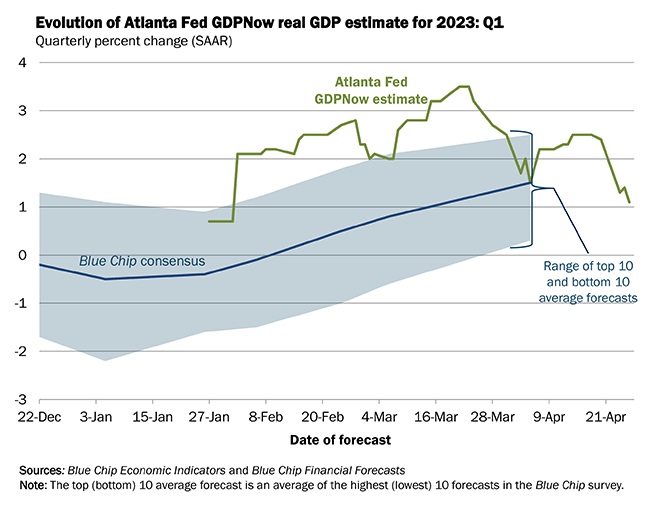

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 1.1 percent on April 26, down from 2.5 percent on April 18. See this in the chart below and learn more here.

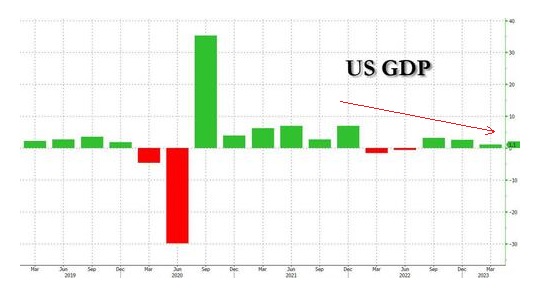

The BEA reported that in Q1, real GDP rose just 1.1% (1.070% to be precise and smack right on top of what the Atlanta Fed said it would be), and a big drop from the 2.6% GDP in Q4. It was also the lowest GDP print since Q2 2022, when growth was negative to the tune of -0.6%. See this in the chart below and learn more here.

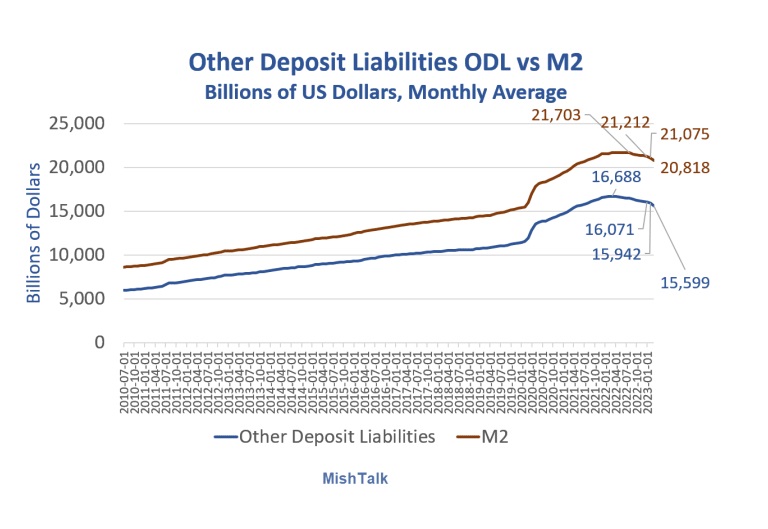

The money supply is declining at the sharpest pace since the Great Depression. See this in the chart below and learn more here. Many economists that shout that money supply doesn’t matter are quick to talk of deflation. But as we discuss with many traders, one bar on a chart doesn’t make a trend.

The point is that the Fed is trying to battle inflation from previously massive increases in the money supply. So the money supply is in decline – and yet we still have a 5% inflation rate with GDP tanking. The unfortunate reality is that the Fed has a long way to go to drain the excesses in liquidity to get back to the trend line of where we were before. So this small current decline in the money supply may be short-lived – it doesn’t mean the linkage between money supply and inflation has been broken.

Is a deep recession coming? Yes, if we continue on the current path. However, at some point, most likely sometime near the end of the summer of 2023 (or earlier), the government and the Fed will reverse course and turn the money “spigot” back on with fiscal stimulus and easier monetary policy to boost the economy – all in time for the 2024 elections. Perhaps another manufactured crisis to justify their actions. But this will only rekindle even more inflation than before.

There seems to be no end to how elites believe they can control economies on our behalf. What could go wrong?

By Tom Williams