China is going pear-shaped as Beijing panics and wheels out the “monetary bazooka.”

Cue the Worldwide inflation.

Just a few weeks ago I did a video about how China is on the edge of recession. Weeks later, the edge of recession has now progressed to a full-blown Chinese fire drill.

So What Happened?

Last week, China’s ruling Politburo held an emergency economic meeting and decided to crank up the money printers to 11, pumping money to consumers, to banks, to property developers, basically to anybody who might spend it.

Bloomberg called it an “adrenaline shot,” as in it’ll pump assets but won’t last long.

Specifically, Beijing’s going to dump about 3.8 trillion yuan—roughly half a trillion dollars—to keep the economy running.

A trillion yuan goes to consumer subsidies, including a hundred twenty U.S. per month child subsidy—a hundred twenty’s big in China—to bribe Chinese mothers into having more kids, which they’ve stopped doing.

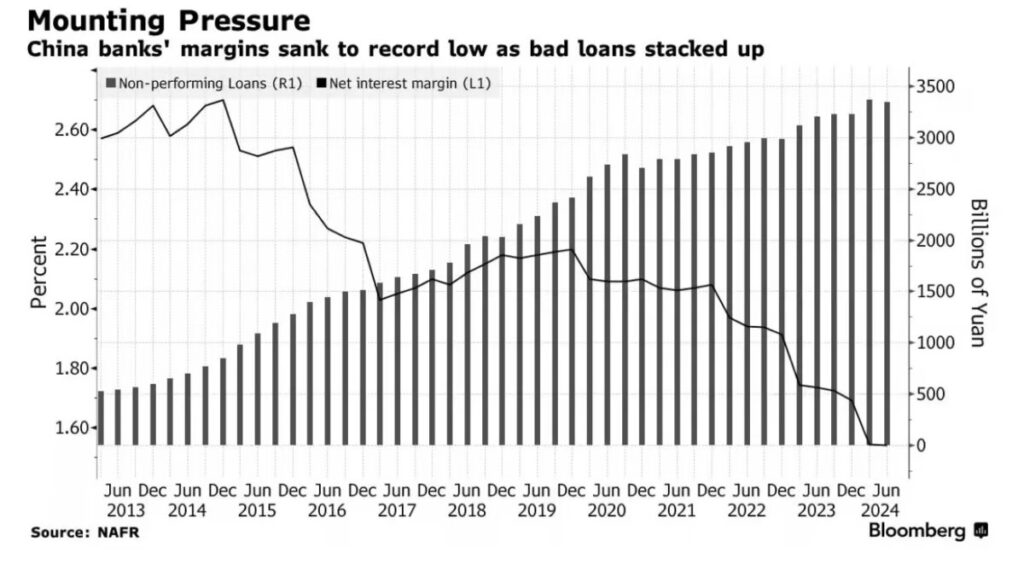

Next up are the banks—as always—who get a cool hundred and forty billion U.S. along with another 100 billion dumped into stock markets.

Allegedly this is all to spur spending—as in the banks lend the money out and the stockholders feel rich—but it would do wonders for the gaping holes in China’s teetering financial industry.

Beyond the Money Dump

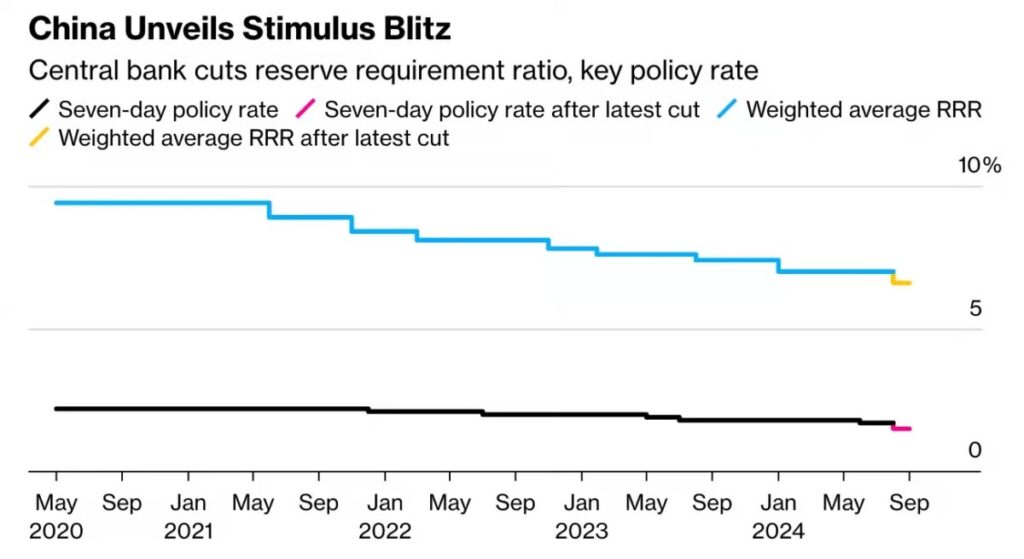

Beyond the money dump, China’s slashing interest rates across the board—which governments do to try and gin up some tissue-fire growth.

They’re slashing downpayment requirements on houses, opening a special credit facility so banks and hedge funds can gamble on stocks, and cutting the reserve requirements for banks—meaning banks can raid their vaults and go on a lending spree.

Put it together, and Beijing’s doing everything it can to get money out in the wild, down to bankrolling gamblers and pouring yet more trillions down the black hole of China’s comically over-built housing market.

You may have seen the ghost towns China’s built; here comes round two.

They’re slashing downpayment requirements on houses, opening a special credit facility so banks and hedge funds can gamble on stocks, and cutting the reserve requirements for banks—meaning banks can raid their vaults and go on a lending spree.

Put it together, and Beijing’s doing everything it can to get money out in the wild, down to bankrolling gamblers and pouring yet more trillions down the black hole of China’s comically over-built housing market.

You may have seen the ghost towns China’s built; here comes round two.