More members of Congress, 329, co-sponsored the Social Security Fairness Act (SSFA) than nearly any other legislative proposal in 2024, but that may not be evidence of lawmakers’ eagerness to fix what ails the retirement pension program—the bill doesn’t address the fundamental insolvency issue.

The SSFA would end two provisions of current law that reduce benefits for millions of public employees at all levels of government with separate pension systems. Eliminating the provisions means more Social Security benefits for such workers.

In other words, the SSFA would increase the total amount of Social Security benefits paid out without providing new revenues to fund them. Even so, the bipartisan proposal is likely to pass Congress and President Joe Biden—who promised in his 2020 campaign to eliminate the provision—is expected to sign it into law when lawmakers reconvene after the election.

For decades, Social Security has been the untouchable “third rail” of American politics that virtually no Democrat or Republican dares to propose changing for fear of angering legions of elderly and disabled voters who depend on the program.

Approximately 70 million Americans are beneficiaries, making Social Security the largest federal entitlement program.

The Social Security Trustees’ latest report projects that the system will become insolvent in 2035 unless Congress approves major reforms soon.

Meanwhile, the ratio of workers paying into the system to beneficiaries is heading downward. The ratio in 1950 was 16 workers to one beneficiary; today that ratio is 2.8 workers per beneficiary. Plus, retirees are living longer today, drawing more benefits over time.

Politicians increase benefits, but are loathe to increase Social Security taxes or slash benefits.

The seemingly impossible challenge for Congress and the White House is how to reform Social Security if increased taxes and reduced benefits are untouchable. The last president to propose a major reform was George W. Bush, who shortly after being re-elected in 2004, suggested privatizing the system.

Under that proposal, Americans would have been allowed to divert some of their Social Security taxes into government-approved private investment funds. Bush hastily dropped the plan after opposition in both parties and in the mainstream media exploded.

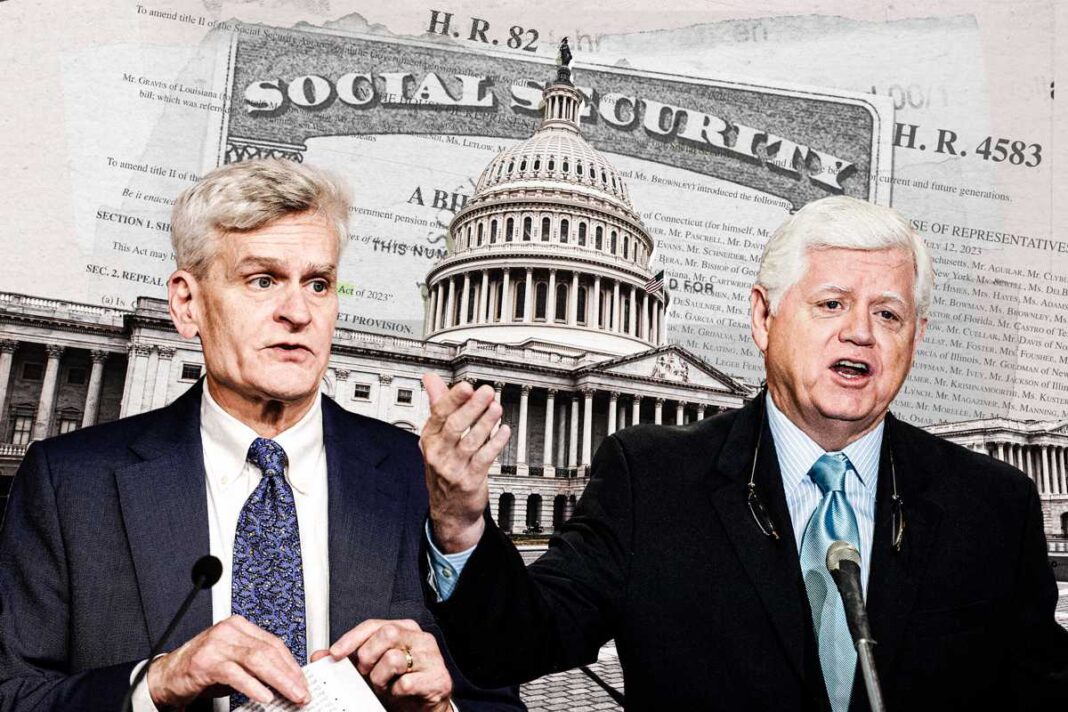

More recently, two lawmakers have ventured beyond the raise-taxes-reduce-benefits dilemma to explore other ways of saving Social Security before it becomes insolvent.