The SEC under new leadership has announced the formation of a crypto task force to overhaul policy on digital assets.

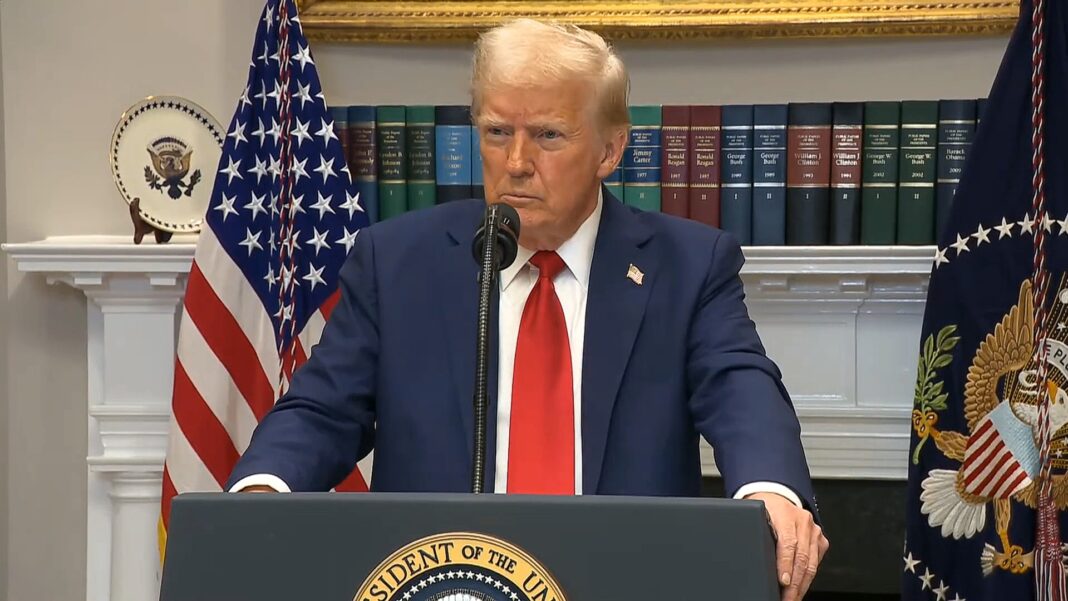

The new leadership of the Securities and Exchange Commission (SEC) has announced the creation of a task force to develop a regulatory framework for crypto assets, the first major push by the Trump administration to reshape policy around cryptocurrencies.

Acting SEC Chairman Mark Uyeda, named to the role by President Donald Trump in a wave of Inauguration Day appointments, announced the new task force in a Jan. 21 statement. Uyeda, seen as crypto-friendly, will temporarily helm the SEC until Trump’s permanent nominee, Paul Atkins, completes his Senate confirmation process.

“The Task Force’s focus will be to help the Commission draw clear regulatory lines, provide realistic paths to registration, craft sensible disclosure frameworks, and deploy enforcement resources judiciously,” the SEC said in a statement.

The effort will be led by Commissioner Hester Peirce, known for her dissents against enforcement actions targeting the crypto industry by the SEC under the leadership of former Chair Gary Gensler, widely seen as a crypto skeptic. Gensler, who resigned on Jan. 20, faced criticism for regulating the industry by enforcement rather than laying out clear rules for companies to follow.

“To date, the SEC has relied primarily on enforcement actions to regulate crypto retroactively and reactively, often adopting novel and untested legal interpretations along the way,” the SEC’s announcement states. “Clarity regarding who must register, and practical solutions for those seeking to register, have been elusive. The result has been confusion about what is legal, which creates an environment hostile to innovation and conducive to fraud.”

Vowing to “do better,” the SEC said the new task force will look to chart a “clear and comprehensive” regulatory path for crypto assets that respects legal boundaries, promotes innovation, and combats fraud.

The task force will collaborate with other federal bodies such as the Commodity Futures Trading Commission, as well as with state and international agencies, while also assisting Congress in crafting crypto regulation.

By Tom Ozimek