The Trump administration is aiming to remedy unfair global trade with reciprocal tariffs.

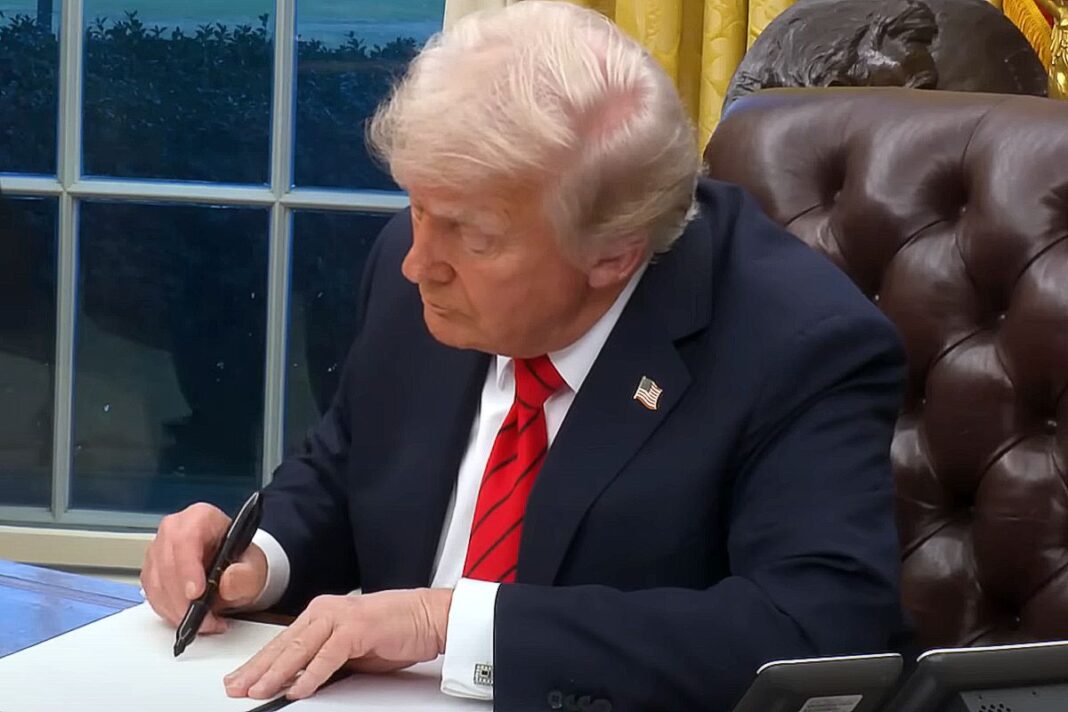

President Donald Trump is set to sign an executive order that raises U.S. tariffs to rates matching other countries.

“Three great weeks, perhaps the best ever, but today is the big one: Reciprocal tariffs!!! Make America Great Again!!!” Trump wrote in all caps on his social media platform Truth Social on Feb. 13.

The president had signaled earlier this week that he would announce reciprocal tariffs, telling reporters that he would impose levies on “every country” that implements import duties on the United States.

“The world has taken advantage of the United States for many years, it charges massive tariffs that we haven’t charged,” Trump said at the Oval Office on Feb. 12.

“We’re going to be doing reciprocal tariffs, which is whatever they charge, we charge very simply.”

White House officials say the president will reveal further details before he meets with Indian Prime Minister Narendra Modi.

It’s unclear if the United States plans to install reciprocal import duties on India.

In an interview with CNBC on Feb. 10, Kevin Hassett, Trump’s top economic adviser, said that the two leaders have a lot to discuss.

“Almost every trading partner has much higher tariffs than we do,” Hassett told the business news network.

The United States maintains a $45.6 billion trade deficit with India.

World Bank figures also reveal a gap in tariff rates between the two nations. In 2022, the U.S. average tariff rate on imports from India was 3 percent. Conversely, India’s average tariff rate on imports from the United States was 9.5 percent.

Overall, according to the World Trade Organization, India’s average tariff is 17 percent. By comparison, the average U.S. tariff rate is 3.3 percent.

Speaking at a campaign rally in Michigan in September 2024, Trump described India as a “very big abuser” regarding global trade but called Modi a “fantastic man.”

“They’re at the top of their game, and they use it against us. But India is very tough,” Trump said.

By Andrew Moran