Even though the products come from the same animal, the U.S. chicken meat industry is much better equipped to handle the bird flu challenge.

The U.S. response to a highly pathogenic avian influenza is driving egg prices to record highs. Still, chicken meat prices remain relatively stable because of a significant difference in how the birds are raised and marketed.

Since 2022, the U.S. poultry industry has been heavily affected by its response to an ongoing outbreak of H5N1 highly pathogenic avian influenza (HPAI). In the 30 days up to Feb. 26, more than 19 million birds had been affected by HPAI outbreaks, according to the Department of Agriculture’s Animal and Plant Health Inspection Service.

The United States’ top egg-producing states—Iowa, Ohio, and Indiana—have lost more than 62 million birds because of culling since the beginning of the outbreak.

The latest Department of Agriculture Egg Markets Overview report, published on Feb. 21, placed the national average wholesale price of eggs at $8.07 per dozen. In some regions of the country, the average was nearly $10 per dozen.

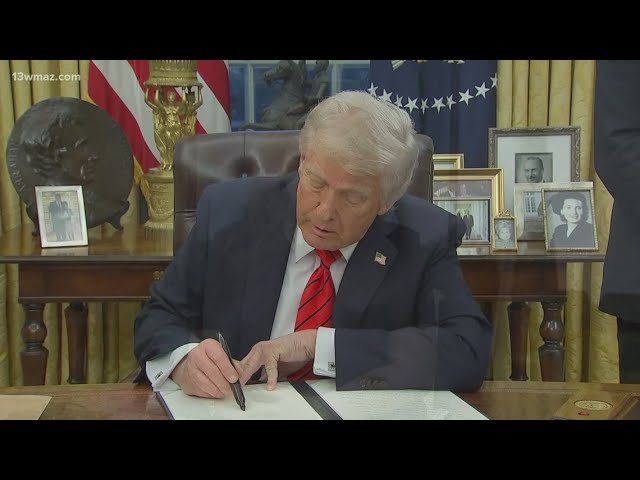

The price of eggs has driven the Department of Agriculture (USDA) to step up its action in response to the crisis. On Feb. 26, Agriculture Secretary Brooke Rollins announced that the agency would spend as much as $1 billion to boost biosecurity on farms and compensate farmers who lost birds to HPAI. The USDA is also weighing the possibility of using vaccines to control the spread of the disease and taking steps to override state animal welfare laws.

Meanwhile, the average retail price of boneless, skinless, conventionally raised, frozen chicken breast meat, according to the USDA’s Agricultural Marketing Service’s weekly report for Feb. 15 through Feb. 21, was $2.99 per pound. Fresh, boneless, skinless breast meat was slightly more expensive, at $3.09 per pound. Boneless, skinless breast meat is the most popular cut in the U.S. market.

According to Consumer Price Index data published by the U.S. Bureau of Labor Statistics, the price of eggs rose by 53 percent between January 2024 and January 2025. During the same period, the average price of “fresh and frozen chicken parts” rose by just 0.8 percent.

The significant difference in price changes is due to multiple factors, including industry size, disease susceptibility, and market economics.