Nonunion workers make up nearly 90 percent of the US workforce. President Joe Biden is giving them the shaft.

The massive $3.5 trillion budget bill Biden and Democratic lawmakers are trying to ram through Congress discriminates against nonunion workers, even forcing some of them to pay higher taxes than coworkers who joined the union.

Union membership in the United States has been declining for a half-century. Biden is bent on reversing the trend, using the federal government to rig the system in favor of organizers and to twist the arms of nonunion workers and employers.

Biden says that unions “brung me to the dance,” and vows to be “the most pro-union president” ever. Nonunion workers are in for a raw deal, starting with the budget bill.

The bill offers a baseline $7,500 tax credit to almost all buyers of electric vehicles but adds a $4,500 sweetener for buying a union-made vehicle. That sweetener discriminates against nonunion auto workers and threatens their jobs.

Toyota objects that it puts “one American autoworker over another.” But Rep. Dan Kildee (D-Mich.), who took the lead in drafting this provision, says: “In a time when we’ve seen decreased rates of unionization,” the federal government should seek to “tilt the scale.”

Coercive tactics like this don’t belong in legislation. But Biden and his party are determined to make the renewable-energy industry unionized — workers’ choice and the economy as a whole be damned.

The bill’s tax provisions slam workers who refuse to support a union’s political activities. Union members can write off a portion of their dues, even if they take a standard deduction. But some workers in union shops choose not to join and instead pay an “agency fee.” That gives them collective-bargaining representation without compelling them to support union politicking. The bill punishes that, barring any deduction for agency fees. Workers get stuck with higher taxes for refusing to fund union politics.

It’s a scheme to coerce workers into paying into the union’s political kitty — which, you guessed it, almost always ends up filling Democratic campaign chests, no matter what the rank and file want. A whopping 88 percent of union donations went to Democrats in 2020, though Biden got only 57 percent of the union vote.

The Democrats’ budget bill also threatens hefty penalties against employers who “misrepresent” employees as independent contractors. It’s a backdoor attempt to discourage employers from using freelancers and gig-economy workers like Uber drivers. Why? Because employees can be organized and made to pay dues. (Democrats would like to eliminate independent contracting altogether, but legislation of that nature can’t be crammed into a budget bill under Senate rules.)

Also slipped into the Democrats’ colossal bill are new limits on what employers can do when a union tries to organize, though these changes will probably be stripped from the bill by the Senate parliamentarian for failing to be budgetary in nature. Even without them, the bill stacks the deck for unions.

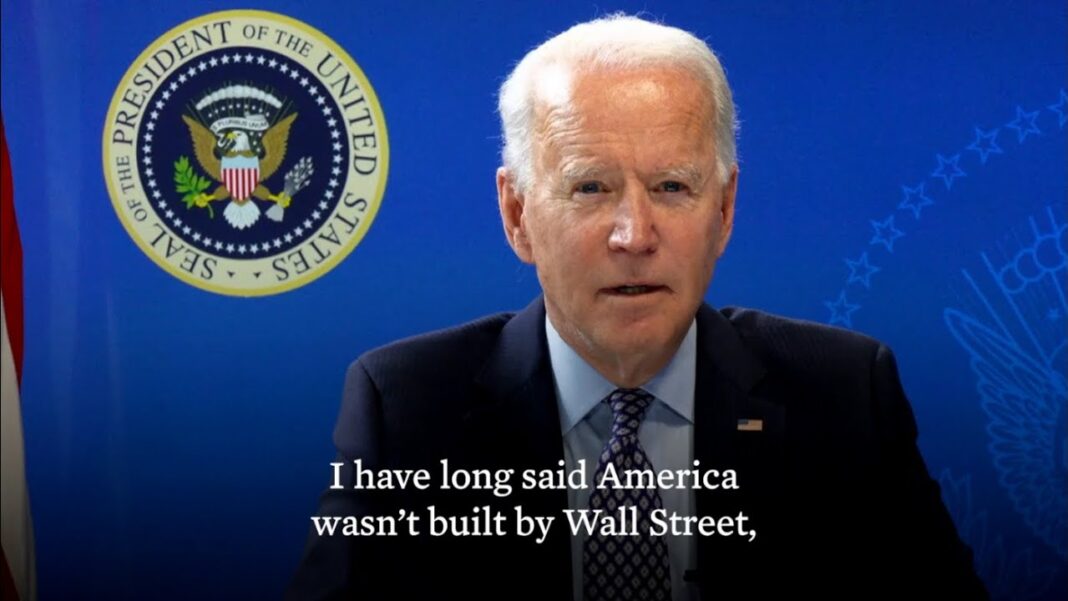

In February, the Retail, Wholesale and Department Store Union launched a campaign to organize Amazon’s warehouse in Bessemer, Ala. Biden got behind the effort, blasting out a pro-union video. The White House pulled out the stops, but Amazon workers still voted 1,798 to 738 against unionization, though there is an ongoing appeal to the National Labor Relations Board.

Unfortunately, Biden and the Democratic Party won’t take no for an answer. They’re also pushing the Protecting the Right to Organize, or PRO Act, which would void right-to-work laws in 27 states, forcing workers to fall in line and pay dues once their workplace is organized. And in April, the White House announced a task force to identify other ways the federal government can push union membership.

Biden claims it’s to build the middle class. In truth, it’s to benefit the Democratic Party, and that’s an outrage.

Workers should be free to choose whether to join a union or not, without Uncle Sam strong-arming them.

Betsy McCaughey is a former lieutenant governor of New York.