CNBC – Gone are the days when companies could just count on post-pandemic pent-up demand to drive results. Some industries are still benefiting from that, including airlines, hotels, casinos, credit card companies, and some restaurants. And as companies seek ways to preserve margins and offset demand issues, price hikes are still an option, at least for companies focused on the core consumer basket.

Big brands have seen earnings propelled by double-digit price hikes – even if it has had a negative impact on demand elasticity. Just look at some of the companies that have raised prices but have seen volumes fall in the latest quarter:

- ConAgra: Prices up 17%, volumes down 8%

- Kraft Heinz: Prices up 15%, volumes down 5%

- Clorox: Prices up 14%, volumes down 10%

- Colgate-Palmolive: Prices up 13%, volumes down 4%

- Coca-Cola: Prices up 12%, volumes down 1%

- Procter & Gamble: Prices up 10%, volumes down 6%

The outlook is getting more cautious from consumer bellwethers. Both Walmart and Home Depot warned that they expect a tougher year ahead. And that caution arrived amid what’s turning out to be the weakest earnings performance for S&P 500 companies since Q3 2020, with earnings falling 2.8% year-over-year so far this season.

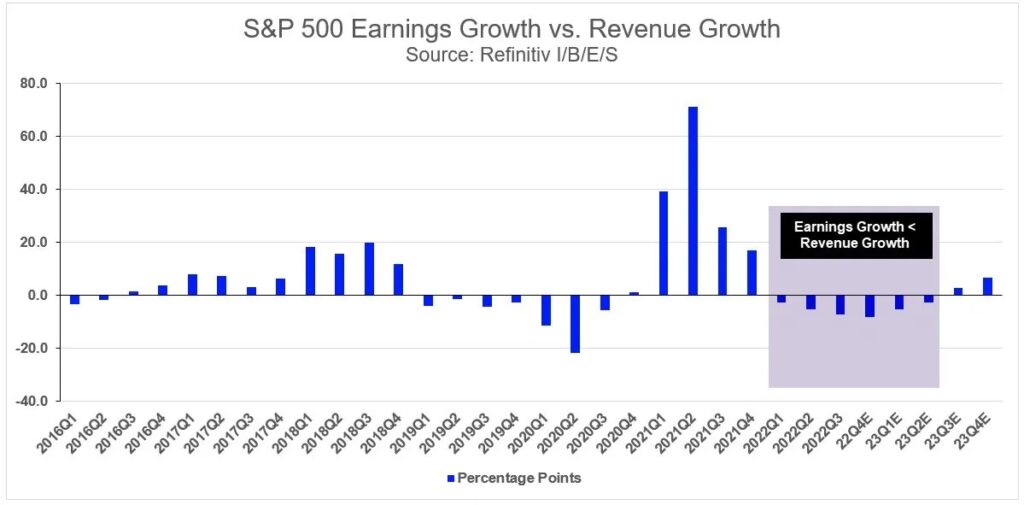

Below is a chart of recent quarterly S&P500 earning growth that is sinking, though many analysts believe in Q1 2023, the earning picture may begrudgingly improve. Will they be right?

Morgan Stanley Managing Director Kathy Entwistle and Strategic Wealth Partners CEO Mark Tepper discussed S&P500 earnings expectations and future market expectations. Kathy Entwistle says consumers “don’t realize” they are paying more than they should for stocks. Mark Tepper shockingly admits that GAP Earnings (removal of one-time charges) are down YoY 23%. See this conversation in the video below.

These poor earnings estimates have caused a strategist at Morgan Stanley to predict that stock indexes would drop as much as 26% at some point in the coming weeks and months, as Bloomberg reported.

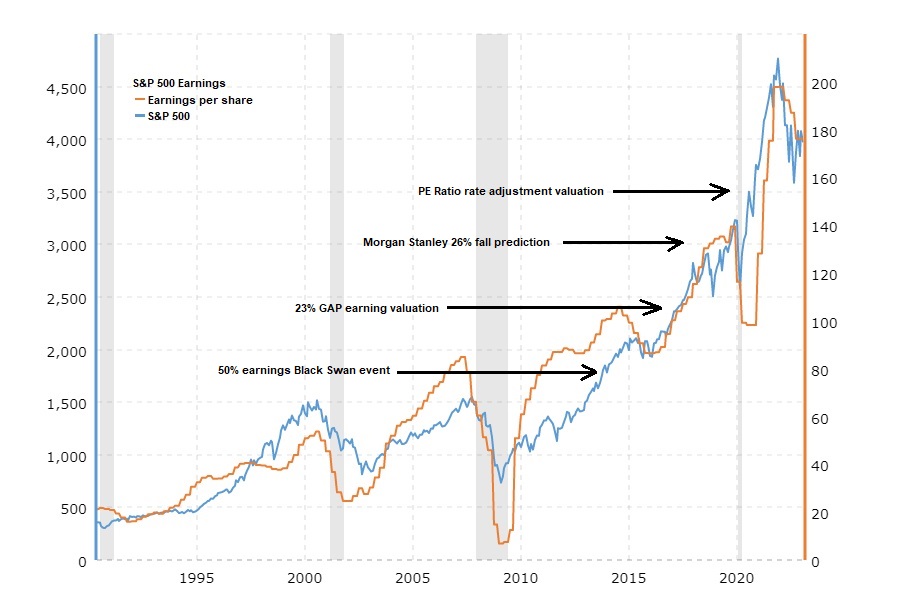

Then there is the issue of Price Earnings (PE) ratios. The recent move in higher rates means that the earnings yields of the S&P 500 should rise as well – or effectively lower the PE ratio. This would suggest that the S&P500 earnings would equate to 15.4 to 16 – it currently is well over 20. These newly adjusted PE ratios would value the S&P 500 at roughly 3,550 – learn more here.

But of course, none of the above earnings adjustments account for any “Black Swan” event that could cause a decline of 20 to 80% earnings crash as happened during the Covid pandemic and in 2008. What if a “Black Swan” event occurred, causing even a moderate crash of 50% in earnings?

With the S&P500 index currently trading around 4000, n the chart below, we can see how far the index could fall in the coming months. Furthermore, what if any earnings expectations are not brief but rather systemic with a longer-term fundamental change in the economy?

Notice that the S&P500 largely trades in line with earnings expectations – except for extremely brief situations. What could be “Black Swan” events on the horizon depends on your view of the world. A Ukrainian war that spins out of control, China deglobalization policies coming from the West over Taiwan, large-scale terrorist attacks, or even a natural catastrophic event. But perhaps this is “pessimism porn.”

The more likely event in any of the cases is that the Fed will soon pivot (reverse QT to QE and drop interest rates) and bail out Wall Street as they have done so many times before. In that event, the stock market goes to new highs, with a new round of hyperinflation.

What could go wrong?