Credit card debt soars, as proven by recent troubling data, elevating the already dire risks of this intense inflationary recession.

Prices surge for consumers at the highest clip in 40 years. The overall Consumer Price Index (CPI) vaults higher at an annualized 9.1% pace, bringing back awful memories of the malaise and stagflation of the 1970s under Jimmy Carter. But actual realized inflation for most citizens stings far worse, especially for those of modest means. The combined inflation ascent for the “have to” non-discretionary items of Gasoline, Groceries, and Utilities rose in June at an astounding 37% rate as a basket.

How have consumers dealt with these skyrocketing prices? The simple answer, unfortunately: via credit cards, particularly for working-class households. Just last week, the Federal Reserve Bank of New York issued a damning report on this credit binge for consumers, into a pronounced economic slowdown.

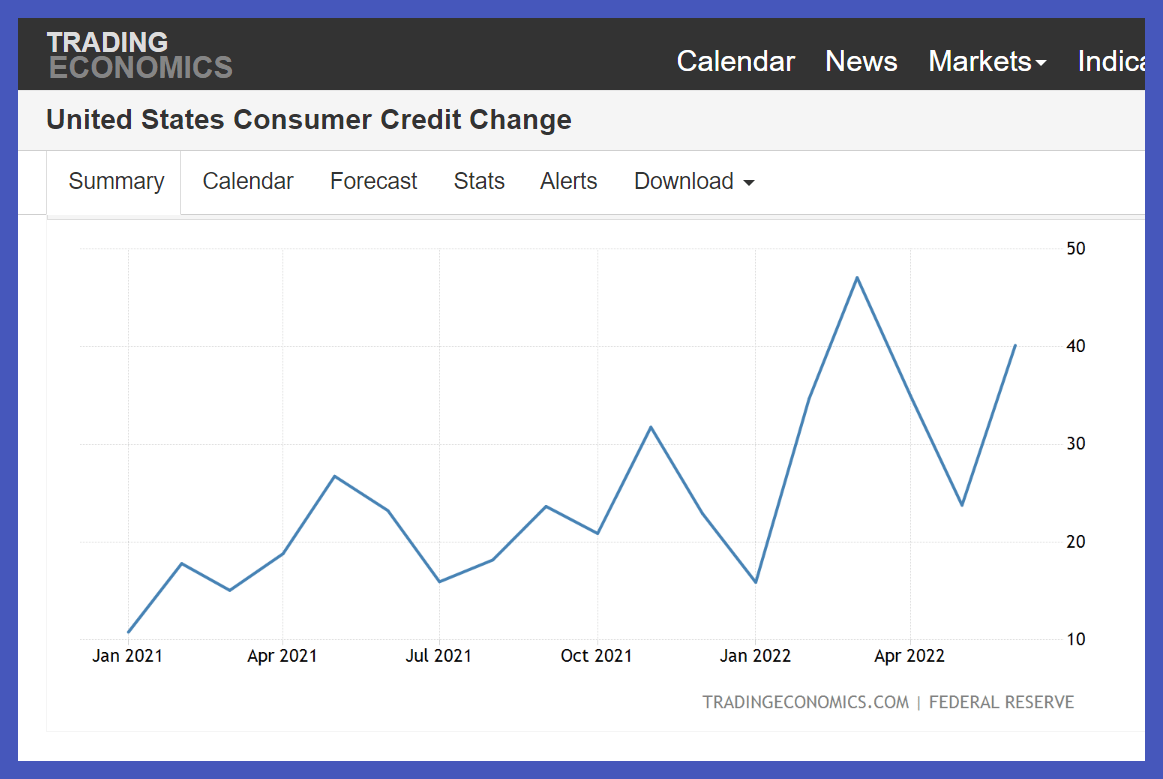

Total consumer debt rose a staggering $40 billion in June, far surpassing Wall Street expectations of a $25 billion increase.

This torrent of borrowing continues the sharp trend of increased consumer indebtedness under Biden, see this chart with figures from the Fed since he took office:

A huge portion of this new debt flows from costly, risky credit card use. In fact, for the April-June second quarter of 2022, total credit card debt rose a staggering $46 billion, the biggest jump in 20 years. Americans pile into new accounts to accomplish this borrowing, opening up a whopping 233 million new cards during that second quarter, the most new cards since 2008. Such comparisons to the Great Recession should worry everyone.

So, stressed and strapped Americans reach for a mountain of credit to pay for the inflation mess created by Biden, Pelosi and collaborator Republicans like Mitch McConnell. The prior savings that had been practically forced by the lockdowns have vanished. In fact, the personal savings rate just plunged to the lowest levels since 2009, another tragic comparison to the economic carnage of the Great Recession.

By Steve Cortes