The communist regime may look for alternative ways to offset the impact of U.S. tariffs, such as creating distractions, say China watchers.

News Analysis

The fast depreciation of the Chinese yuan suggests a deliberate attempt by Beijing to partially offset the impact of tariffs, according to China analysts and economists.

On April 8, China’s central bank, the People’s Bank of China, set the yuan’s central parity rate at 7.2038, marking the first time since September 2023 that the rate has surpassed the 7.20 threshold.

As of April 11, the exchange rate is approximately 7.291 yuan per USD.

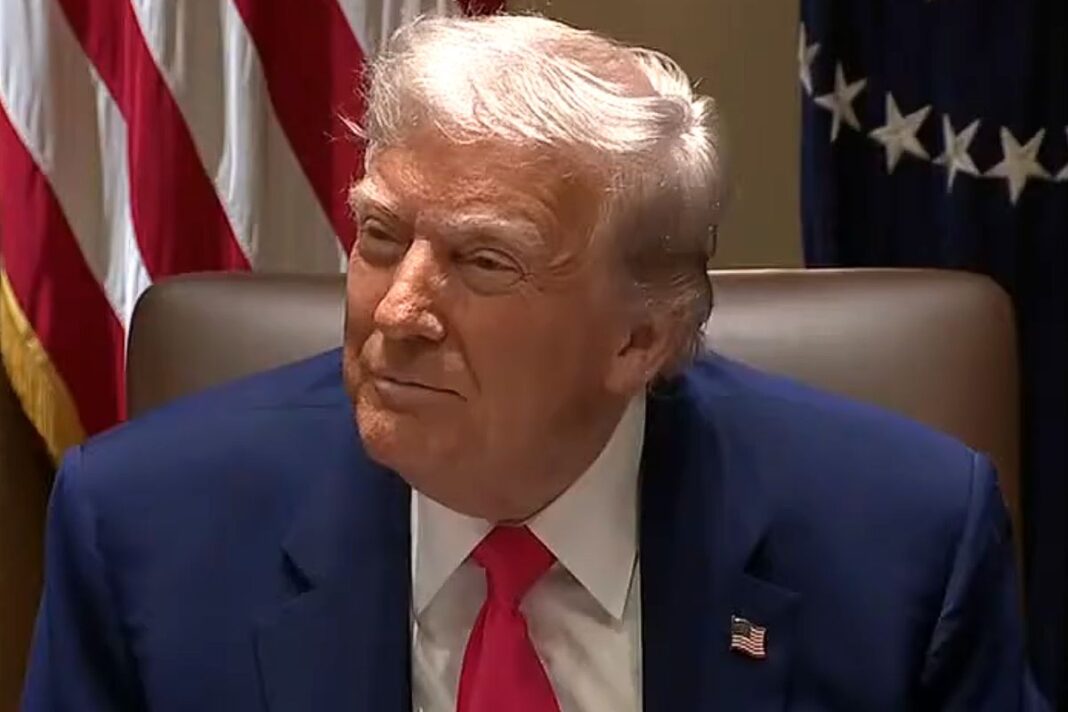

This came after President Donald Trump announced cumulative tariffs on Chinese products would increase to 125 percent, which followed the CCP’s latest tariff hike, raising duties on U.S. goods to 84 percent.

Trump has criticised Beijing for manipulating the Chinese yuan, and Treasury Secretary Scott Bessent—who warned the regime against using depreciation to retaliate against American tariff hikes—stated that such actions would lead to further escalation.

Analysts: CCP to Use Depreciation to Offset Tariffs

The sharp decline suggests Beijing is deliberately trying to offset tariffs, say Frank Qin, a senior political and economic analyst.

“In the past, the People’s Bank of China—the central bank under the CCP—would set a daily trading band of plus or minus 2 percent, within which the yuan’s exchange rate could fluctuate. If the rate approached or broke through a key psychological threshold, the central bank would typically intervene,” he told The Epoch Times. “However, this time, we’ve seen no such intervention throughout the process, which clearly indicates that the authorities are deliberately allowing the currency to depreciate.”

Qin highlighted the CCP’s use of devaluation during the last U.S.-China trade war.

“During the U.S.-China trade war from 2018 to 2020, the [yuan] depreciated by over 12 percent,” he said. “Therefore, they may adopt a similar strategy this time. In this context, the warnings issued by President Trump and Treasury Secretary Mnuchin are quite reasonable.”

Nonetheless, Qin believes that the CCP will find it hard this time to respond to the heavy tariffs imposed by Washington and the rest of the world through a significant devaluation.

“On one hand, the tariffs are simply too high. As of Wednesday [April 9] afternoon, we saw that the United States had increased them to 125 percent. Therefore, unless the [yuan] depreciates by several times over, it won’t be able to offset the impact,” he said.

By Cindy Li