Cronyism abounds, and regular Americans owe zero to Silicon Valley

The moguls of Silicon Valley largely installed Joe Biden into the White House. But the man they coronated has turned into a disaster for their enterprises. The pain of Biden’s created economic crisis afflicts all of America, of course…but Tech has been hit first and hardest.

Now, many of those same Tech titans practically beg for public assistance to bail out their investments and deposits as banks flail because of the runaway inflation created by their chosen man. Specifically, venture capital firms clamor for guarantees from regular taxpayers to cover the losses – or potential losses – of their favored banks.

For years, these venture capital firms have successfully projected a public image of daring dreamers who provide the investment jet fuel to propel American innovation. For a time, that image reflected reality, to be sure.

But today, like so many formerly bold institutions of American life, VC descends largely into a rent-seeking space of connected, credentialed cronies who leverage their access to transform leftist public policies into private profits.

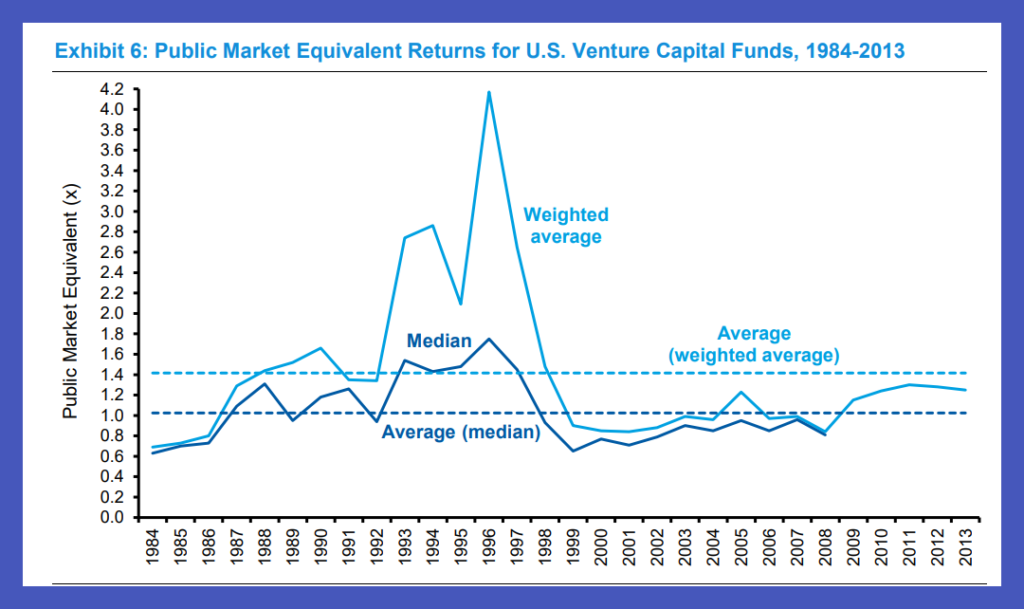

With some notable exceptions, these predictable and formulaic VCs have generally provided poor risk-adjusted returns to investors. Even worse, now that these venture firms and their connected companies feel the full wrath of Biden’s economic failures, the industry clamors for bailouts from regular Americans.

Venture Capital Then and Now

In the mid to late nineties as the internet came into ubiquity in American life, the VC industry flourished with smart early investments in firms that dominate American business to this day. Among these giant VC home runs were: Amazon, Google, eBay, Facebook, PayPal, and Netflix.

But since the 1990’s, despite massive investment inflows into VC and an elevated public profile for the industry, returns have disappointed overall. Consider this Morgan Stanley 30-year chart of investor gains in VC for the 3 decades from 1984-2013.

By Steve Cortes