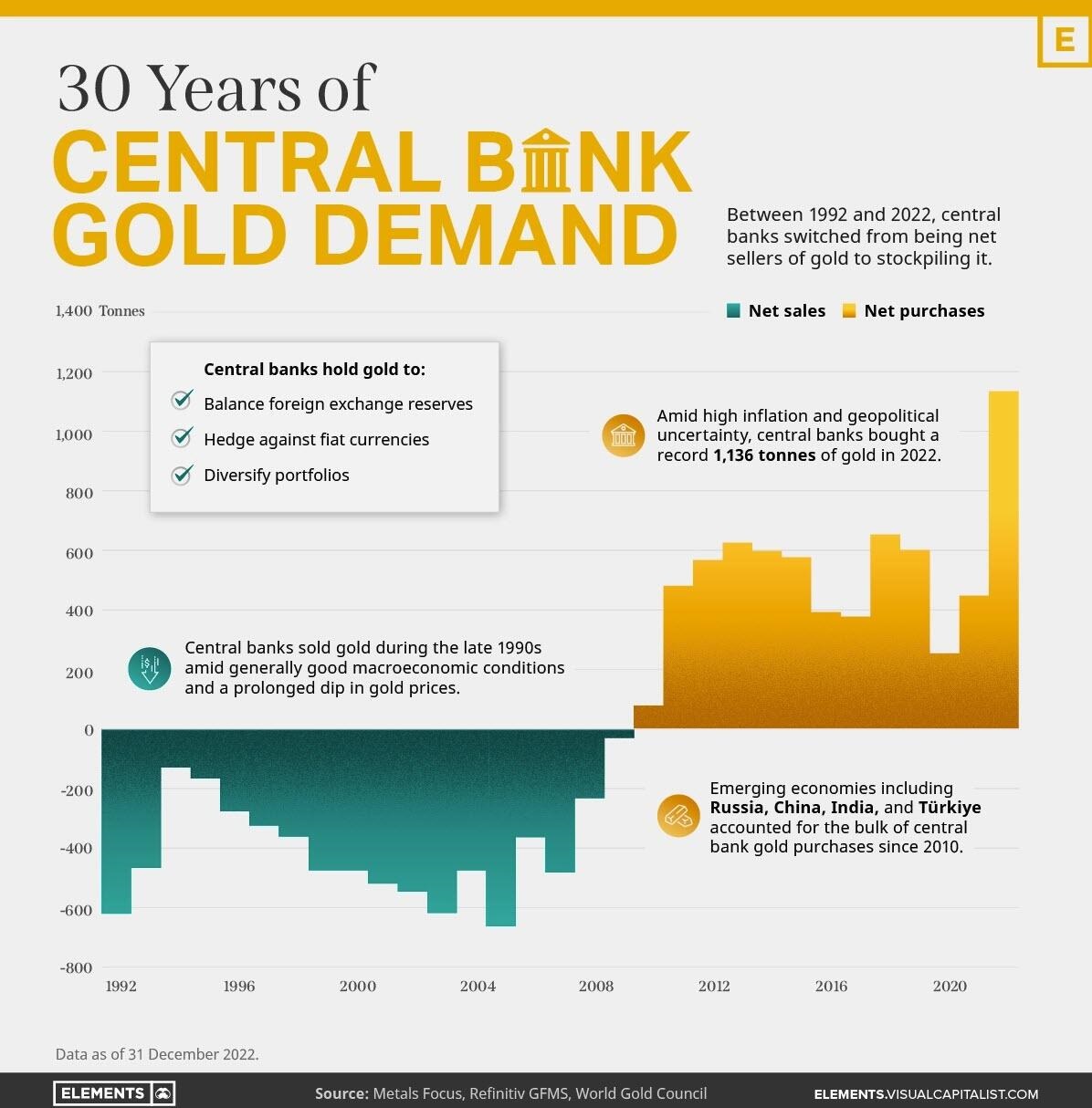

Did you know that nearly one-fifth of all the gold ever mined is held by central banks?

As Visual Capitalist’s Govind Bhutada details, besides investors and jewelry consumers, central banks are a major source of gold demand. In fact, in 2022, central banks snapped up gold at the fastest pace since 1967.

However, the record gold purchases of 2022 are in stark contrast to the 1990s and early 2000s, when central banks were net sellers of gold. The below infographic (learn more here) uses data from the World Gold Council to show 30 years of central bank gold demand, highlighting how official attitudes toward gold have changed in the last 30 years.

This infographic doesn’t need much commentary. Central banks know all too well that they are currency debasing at record rates and are preparing for the eventual implosion. If they really believe that inflation is well in check, why are they buying so much gold?

If central banks are preparing for this implosion, shouldn’t you also do so?

By Tom Williams