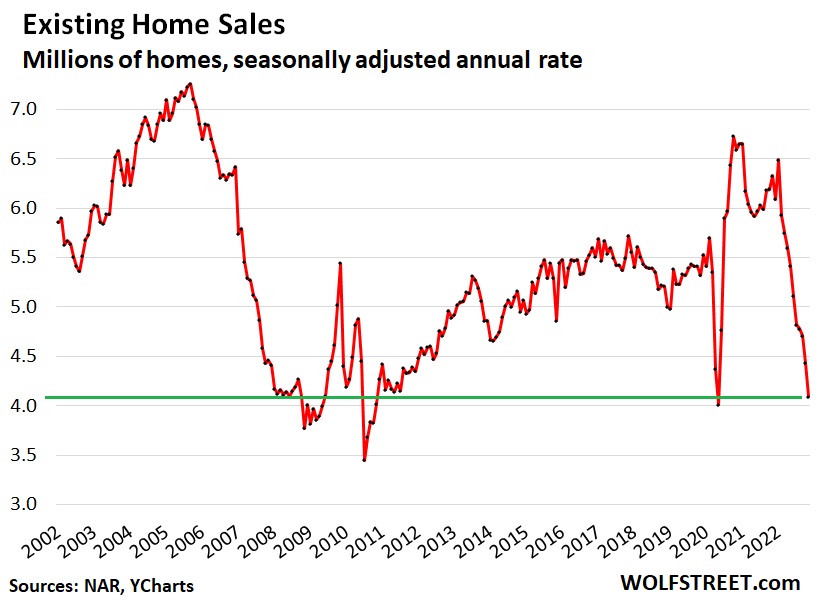

Sales of all types of previously owned houses, condos, and co-ops plunged by 7.7% in November from October, the 10th month in a row of declines, to a seasonally adjusted annual sales rate of 4.09 million homes, nearly matching the lockdown-low in May 2020. And beyond May 2020, it was the lowest sales rate since deep into Housing Bust 1, November 2010, according to data from the National Association of Realtors.

Year-over-year, sales fell by 35%, the 16th month in a row of year-over-year declines. Compared to the recent free-money peak in October 2020, sales were down 39% – see this in the chart below and learn more here. An ugly picture indeed.

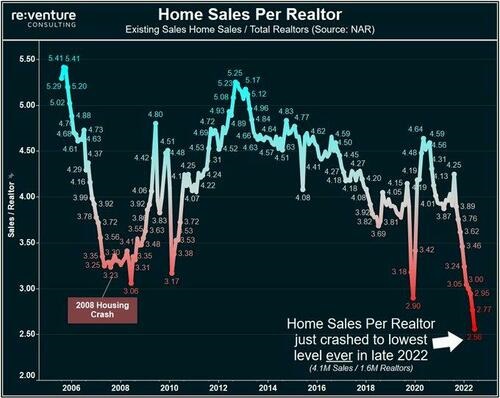

So what effect is this having on the realtor industry, especially realtor positions? First, it is useful to look at the current state of how many realtors we have today. We have significantly more realtors today than during the last housing bubble back in 2007. So along with the bubble in housing, there is a bubble in realtor positions. See this in the chart below and learn more here.

Nick Gerli, CEO and founder of real estate Reventure Consulting, said, “30% of Realtors will likely quit during this ongoing housing crash. Once that happens, you’ll know the bottom is approaching.”

“The housing bubble has popped, but the bubble mentality has NOT. 1.6 Million Realtors are still “holding on,” thinking the housing market will improve in 2023,” Gerli said. Gerli expects a wave of realtors to “inevitably quit in 2023. And when they quit, it will likely coincide with investors, flippers, and stubborn sellers “quitting” as well.

Below is a chart on the number of home sales per realtor. It has plunged to lows even lower during the 2008 crash as well. However, it should be noted that part of this plunge was due to excess already in realtor positions – the high home prices and easy sales made it simply too profitable for aspiring realtors to jump into the market.

All this sounds quite negative if you are a realtor. For sure, Q1 and into Q2 will be difficult. However, here are a few points that may give you some cheer.

- With all the geopolitics and talk of a coming recession coming to a head in early 2023, after another sharp down thrust in asset markets, the Fed may come in and start easing quickly in early 2023, giving a rebound in the housing markets. It all depends if the Fed pivots quickly or not.

- The recession coming in 2023 is a “price” recession, not necessarily a “jobs” recession. This means that there may be less force selling than there was in 2008. Remember, the time to buy assets is when there is blood in the streets.

- If more crisis comes (from whatever source), the “flight from where you are at,” like after Covid, may re-emerge.

If you are a realtor and can survive a couple of dreadful quarters, there may be light at the end of the tunnel in the second half of 2023. Is this a good time to get into the real estate market? Give us your take in the comment section below.

By Tom Williams