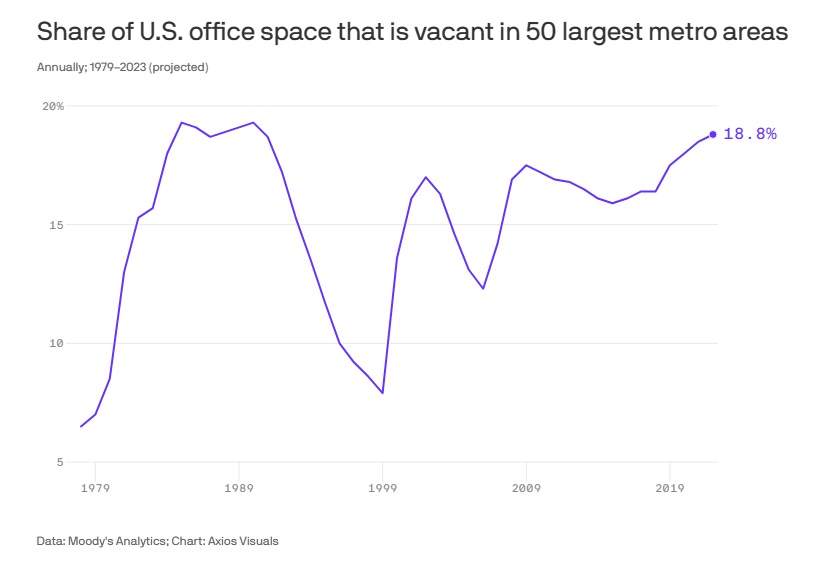

Office vacancy levels are approaching highs last seen during the savings and loan crisis in the 1980s. It appears that a reckoning in the office market, widely anticipated since the start of the pandemic, is upon us.

- “We’re not ready to say that this is a cliff for the office sector. But I think right now we’re finally entering the true turbulent times,” Thomas LaSalvia, director of economic research at Moody’s Analytics, told Axios.

- Vacancies refer to the share of office space that is not leased by a tenant – as opposed to leased office space that’s mostly deserted.

See this in the chart below and learn more here.

At the end of last year, even Class A buildings saw a drop in occupancy, per a new report from Moody’s.

- Some office landlords are showing signs of distress, as the WSJ reported. Brookfield Asset Management last month defaulted on $750 million in debt on two 52-story office towers in Los Angeles (It still holds hundreds of properties).

- These properties were Class A but faced competition from even-fancier Class A+ properties with better amenities, according to Moody’s report. Brookfield’s moves might “spur other landlords,” it says.

- Meanwhile, Columbia Property Trust recently defaulted on a $1.7 billion loan backed by seven office properties, mainly due to the rise in interest rates.

- The company took out a floating-rate loan in December 2021, according to Moody’s. It’s gone from paying around 3% on loans to 6%.

Rather than lay off workers during a time of labor shortages, companies are looking to real estate as a way to cut costs. Reducing office space appears to be the cost-cutting tool of choice.

See more Chart of the Day posts.

By Tom Williams