Venture capital (VC) is a form of private equity and a type of financing that investors provide to start-up companies and small businesses that are believed to have long-term growth potential. Venture capital generally comes from well-off investors, investment banks, and other financial institutions.

However, it does not always take a monetary form – it can also be provided in the form of technical or managerial expertise. Venture capital is typically allocated to small companies with exceptional growth potential or companies that have increased and appear poised to continue expanding.

For new companies or ventures with a limited operating history (under two years), venture capital is increasingly becoming a popular – even essential -source for raising money, especially if they lack access to capital markets, bank loans, or other debt instruments. Though it can be risky for investors who put up funds, the potential for above-average returns is an attractive payoff. The main downside is that the investors usually get equity in the company and, thus, a say in company decisions.

- Venture capital financing is funding provided to companies and entrepreneurs. It can be provided at different stages of their evolution, although it often involves early and seed round funding.

- Venture capital funds manage pooled investments in high-growth opportunities in start-ups and other early-stage firms and are typically only open to accredited investors.

- Venture capital has evolved from a niche activity at the end of the Second World War into a sophisticated industry with multiple players that play an essential role in spurring innovation.

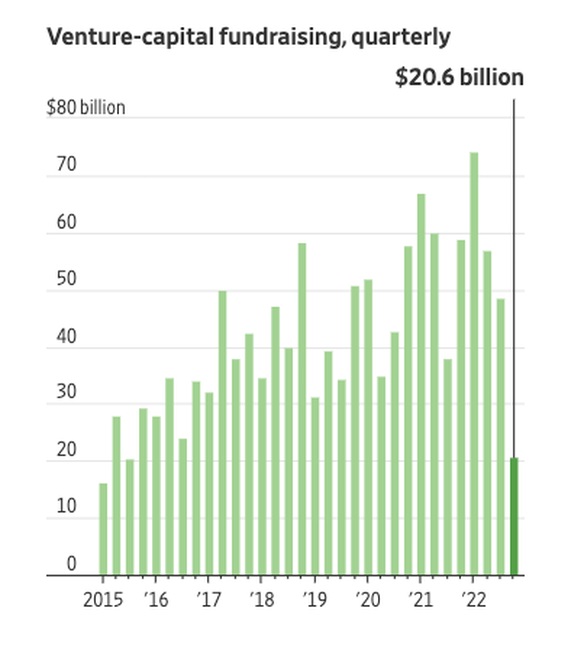

So what does the VC market look like today? Fundraising by VC firms plunged to a nine-year low in the fourth quarter as rising market volatility, geopolitical uncertainty, and higher inflation spooked investors, according to WSJ.

Preqin Ltd., a firm that tracks venture-fund data, released a new report that shows VCs raised a measly $20.6 billion in new funds in the fourth quarter. That was a whopping 65% decline compared with the quarter a year earlier and the lowest fourth-quarter amount since 2013. See this drop-off in the chart below and learn more here.

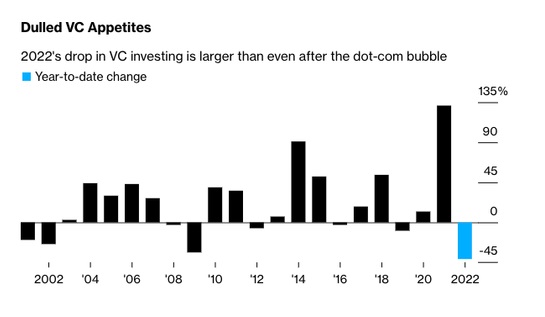

VC investments recorded the sharpest drop in more than two decades last year, surpassing the declines of the Dot-Com crash and financial crisis. See the rate of the recent decline in the chart below.

Why the decline in investing in the future? VCs tend to be optimistic about the long-term because the investments often take years to pan out. When VCs begin to pull out of the market, it is usually a signal that the economy’s future prospects are not good. What could be driving this dreary VC market sentiment?

- Many economic analysts believe the globe is heading into a recession in 2023. Any potential customers from new VC start-ups become problematic.

- There is a belief that global trade may slow down (deglobalization) due to geopolitical conflicts that may cause markets to constrict via various sanction regimes and the desire for many countries to source inside their own country.

- Climate change and more extensive government controls are driving more regulations. More regulation raises the costs of new innovations and/or blocks bringing new ideas to markets.

- As global interest rates rise, investors are happy to collect paid interest, making other non-VC investments more attractive.

Of course, inside these reasons stated above, niches can be developed, and innovators may try to capitalize on opportunities this environment creates. That being said, innovations based on arbitrary government mandates can be more dubious that innovations based on actual customer needs.

Remember, innovations are a crucial determinant in productivity that leads to higher standards of living. Fewer innovators do not bode well for global growth and jobs. Why are VCs less optimistic today? Give us your take in the comment section below.

By Tom Williams