We Are In For A Economically Stagnant Winter and a Blue Christmas

Steve Cortes joins Peter Navarro and Steve Bannon on the War Room to discuss the economic peril of the Biden Inflation surge.

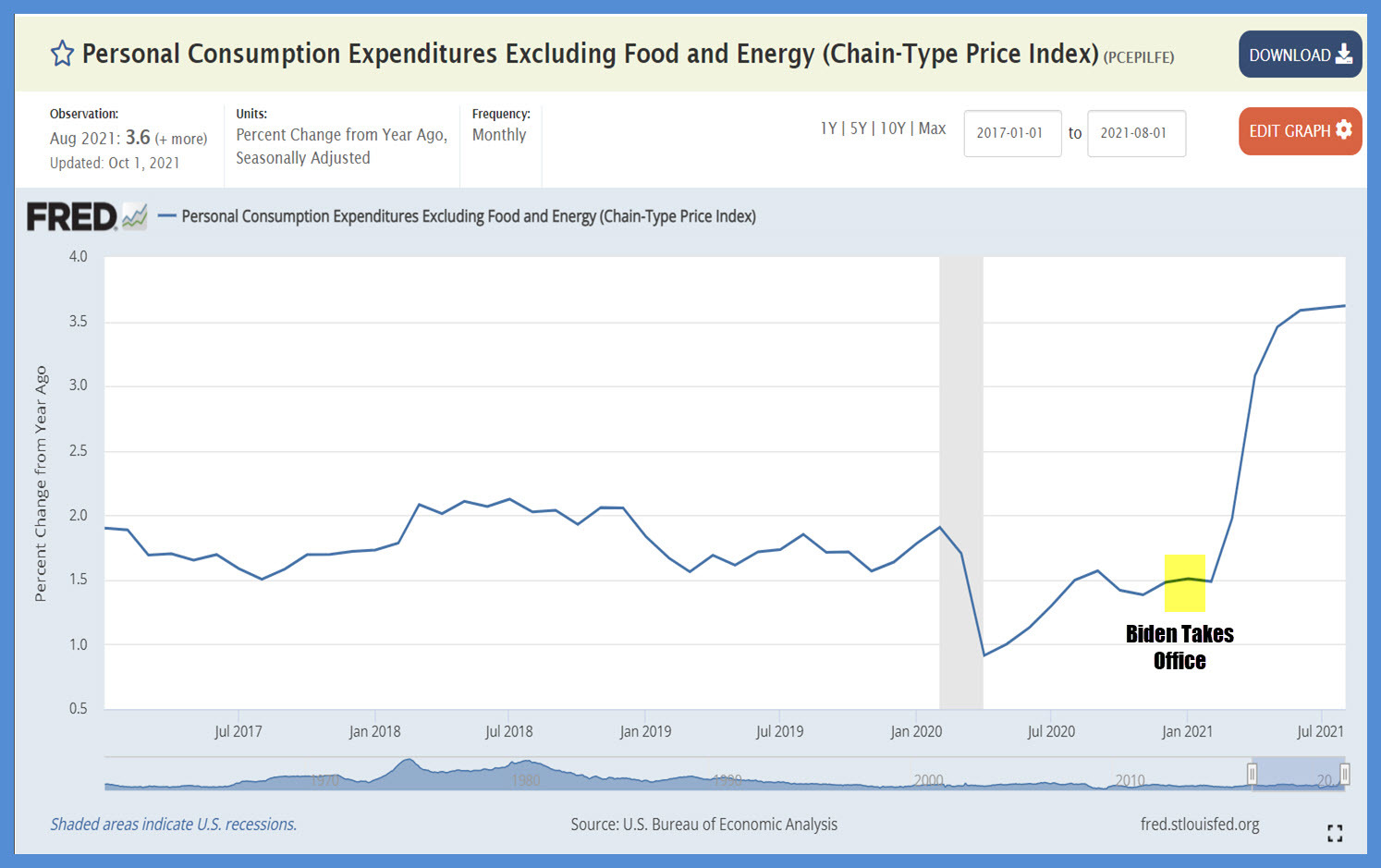

First, 5 year chart of PCE Core Inflation, highest in 30 years (1/6)

Biden’s reckless spending and borrowing is leading to a “Dark Winter” and a “Biden Blue Christmas” as you can see by the Biden inflation surge in various economic stats and market prices. It will only get worse if Dems pass trillions in more spending.

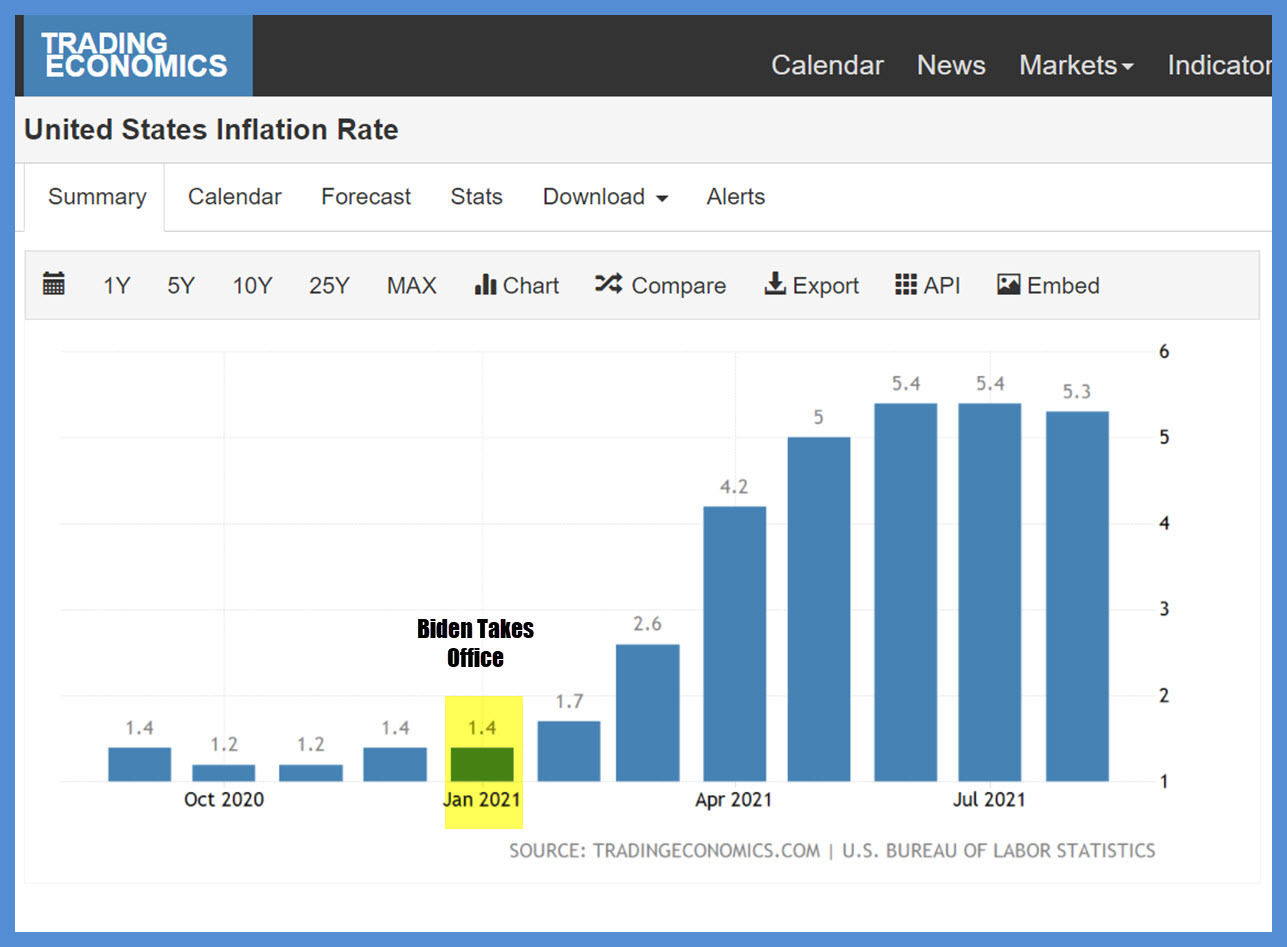

Trading Economics – United States Inflation Rate

Now, the overall Consumer Price Index back a year, highest jumps since 2008. Note how tame Inflation was under President Trump, then exploding with Joe Biden, Nancy Pelosi, and Chuck Schumer at the economic helm…(2/6)

Trading Economics – Cotton

Let’s get to market prices. Cotton is up 51% since the Nov 2020 election, as Commodities from Coffee to Crude vault higher amidst the Biden Inflation Spike, punishing Consumers (3/6)

Trading Economics – Propane

This winter will be brutal for people of modest incomes heating their homes. Natural Gas prices have soared, in part thanks to Biden’s war on U.S. Energy – same story here with Propane, which has almost tripled in price since Election Day…(4/6)

United States Government Bond 10Y

Financial Markets globally respond to the Biden Inflation Spike. Here, a one year chart of benchmark 10 Year U.S. Treasury Yields — jumped from historic low of 0.88% on Election Day to 1.46% now. (5/6)

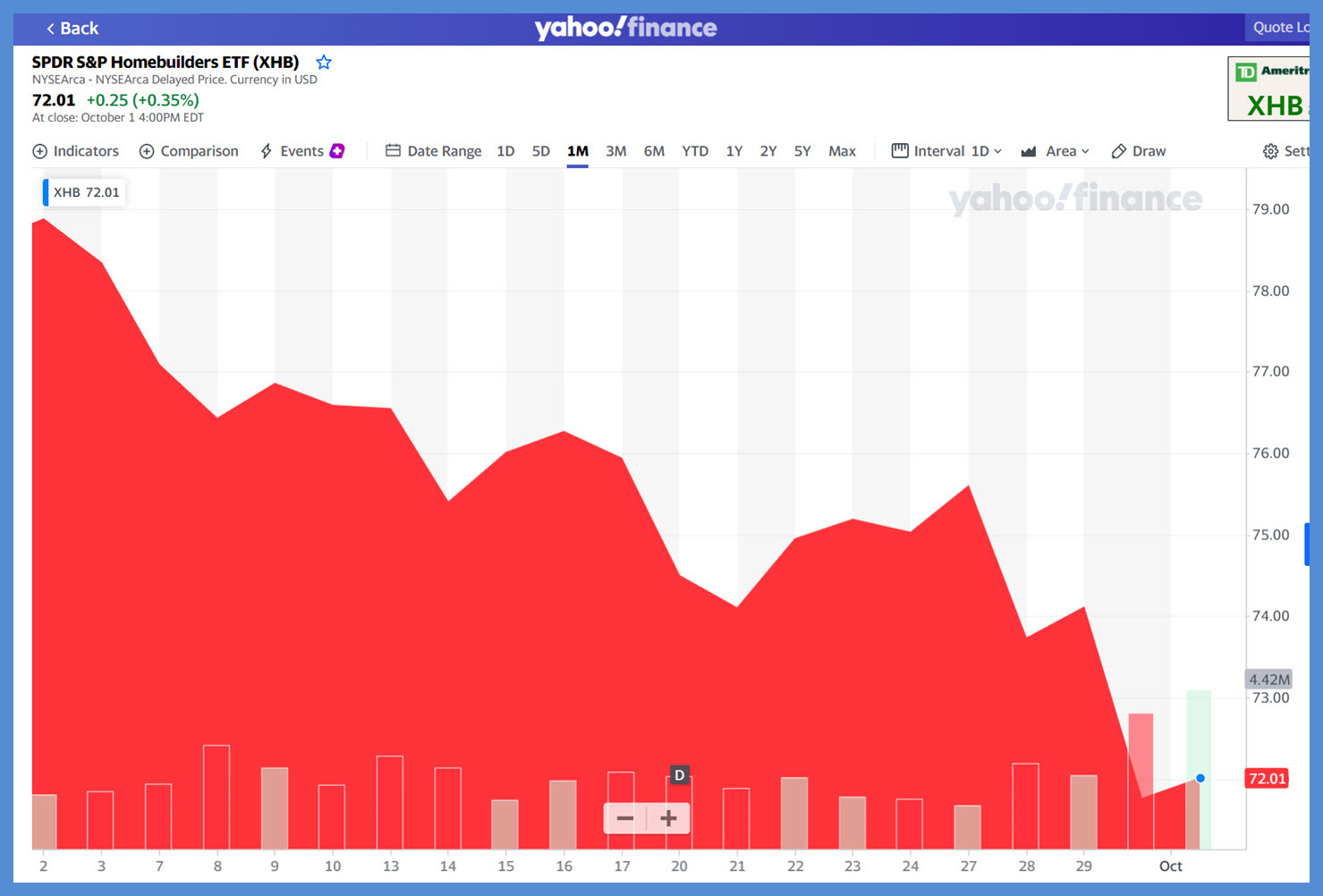

SPDR S&P Homebuilders ETF (XHB)

Housing led the U.S. recovery from the Spring 2020 lockdowns, but now the sector sputters thanks to Biden. Here is a one-month chart of the Housing ETF, the XHB, which lost 9% in September (6/6)