The Federal Reserve has announced it is taking a step closer to the potential adoption of a central bank digital currency (CBDC) by ramping up its efforts to study the use of fast-evolving technologies for digital payments, with a particular focus on the opportunities and risks associated with this new type of digital dollar.

“Technological advances are driving rapid change in the global payments landscape,” the Fed said in a statement, adding that it is actively exploring how it might refine its role as a core payment services provider and as the issuing authority for U.S. currency, while promoting monetary and financial stability, as well as the safety and efficiency of the payment system.

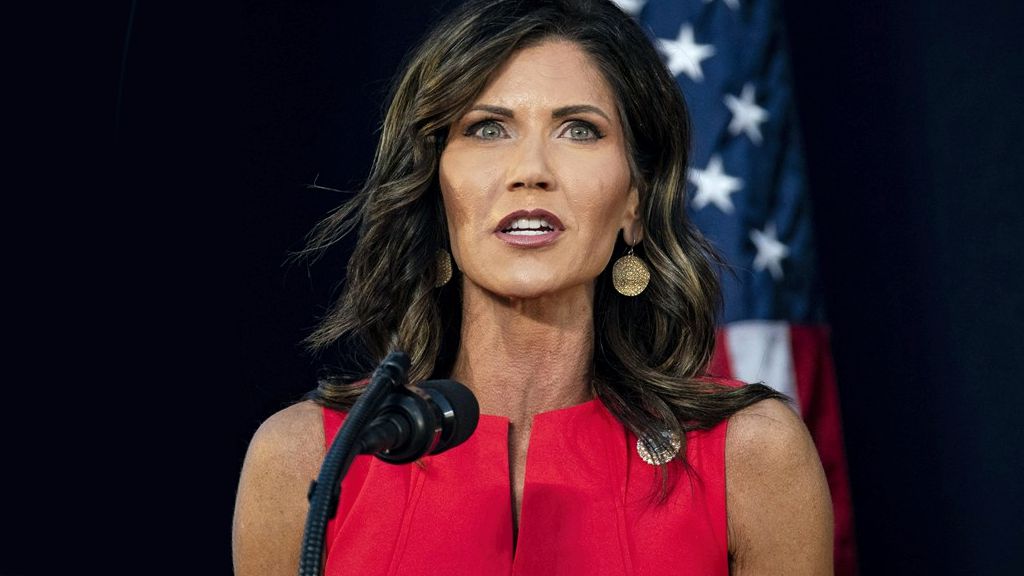

“In pursuit of these core functions we have been carefully monitoring and adapting to the technological innovations now transforming the world of payments, finance, and banking,” said Federal Reserve chair Jerome Powell, in a video address Thursday (pdf).

Inspired by Bitcoin, an essentially non-regulated virtual currency that uses a decentralized digital ledger technology known as a blockchain to validate and secure transactions, central banks around the world have been mulling the adoption of a CBDC—a new type of central bank liability issued in digital form. Central bank digital currencies would use a similar—though centralized—electronic record or digital token to represent the virtual form of a fiat currency, which would be issued and regulated by the authorities.

Powell said the Fed plans to publish this summer a discussion paper that will explore the implications of fast-evolving technology for digital payments, with a particular focus on the possible issuance of a U.S. central bank digital currency for use by the general public.

“We think it is important that any potential CBDC could serve as a complement to, and not a replacement of, cash and current private-sector digital forms of the dollar, such as deposits at commercial banks,” Powell said. “The design of a CBDC would raise important monetary policy, financial stability, consumer protection, legal, and privacy considerations and will require careful thought and analysis—including input from the public and elected officials.”

BY TOM OZIMEK

Read Full Article on TheEpochTimes.com

Chair Powell’s Message on Developments in the U.S. Payments System PDF

payment-innovation-message-transcript-20210520