The loan repayment push aims to stabilize the $1.6 trillion federal student debt portfolio and reduce taxpayer burden amid rising delinquency.

Federal student loan collections—including wage garnishment—will resume within weeks, the Education Department confirmed on April 21, ending a five-year freeze and setting the stage for millions of defaulted borrowers to face renewed enforcement.

The move, announced in a Monday press release, marks the formal end of a years-long pause on federal student loan collections that began in March 2020 under President Donald Trump during the COVID-19 pandemic and was extended multiple times by the Biden administration.

As of early 2025, more than 9.7 million borrowers were behind in payments, and officials say restarting collections is necessary to protect taxpayers and restore accountability to the $1.6 trillion federal student loan system.

“American taxpayers will no longer be forced to serve as collateral for irresponsible student loan policies,” Education Secretary Linda McMahon said in a statement. “The Biden Administration misled borrowers: the executive branch does not have the constitutional authority to wipe debt away, nor do the loan balances simply disappear. Hundreds of billions have already been transferred to taxpayers.”

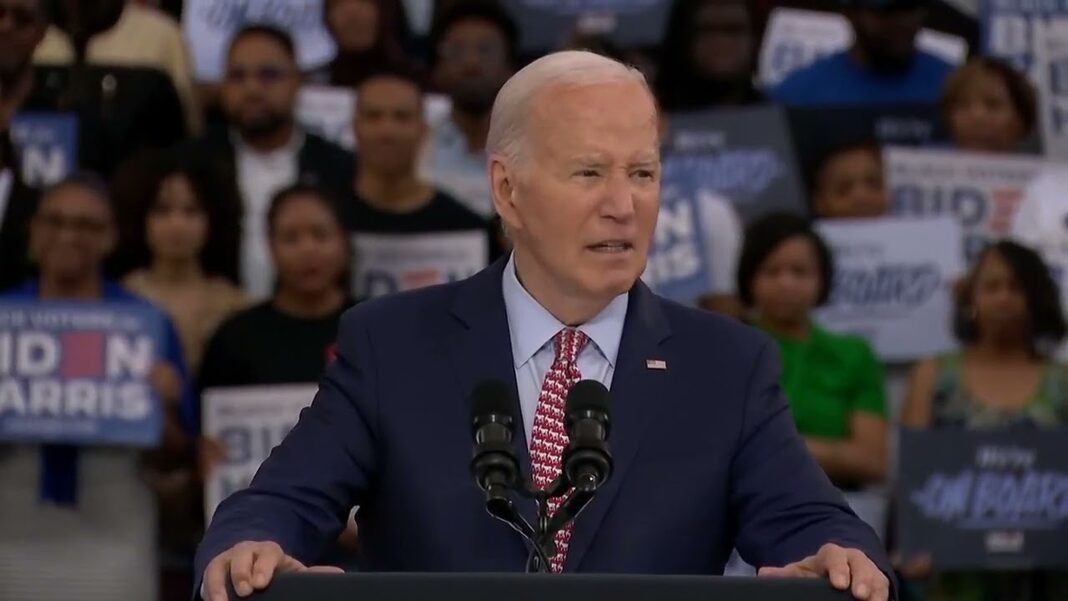

McMahon was referring to sweeping debt cancellation plans unveiled by President Joe Biden, which aimed to forgive student loans through executive action. Those efforts were ultimately blocked by the U.S. Supreme Court in 2023, which ruled that such measures exceeded the president’s authority without congressional approval.

Supporters of Biden’s plans said that widespread forgiveness would relieve financial stress, reduce economic disparities, and stimulate the economy. Critics criticized the proposals as unlawful, fiscally irresponsible, and unfair to those who had already paid off their debts or never borrowed in the first place.

On Monday, the Education Department reported that roughly 5 million borrowers are already in default, with another 4 million in late-stage delinquency—meaning they are between 91 and 180 days behind on payments. Without intervention, officials warned, nearly 10 million Americans could be in default by midyear, representing close to 25 percent of the federal student loan portfolio. Only 38 percent of borrowers are currently in repayment and current on their loans.

By Tom Ozimek