Billionaires are probably ‘sitting back laughing right now,’ former IRS lawyer William Henck tells FOX Business

William Henck, a former Internal Revenue Service (IRS) lawyer who was forced out after making allegations of internal malfeasance, said the government will target middle-income Americans with new audits under the Inflation Reduction Act.

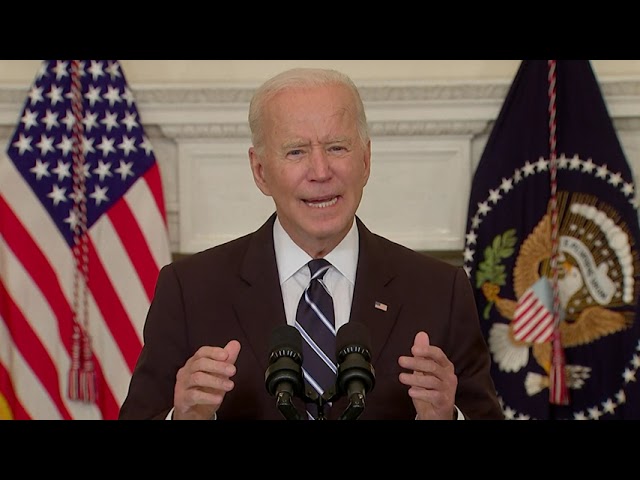

Henck, who worked at the IRS for 30 years until departing in 2017, slammed the IRS and others who have argued additional funding would only result in increased audits for billionaires and corporations. The Inflation Reduction Act, which President Biden is slated to sign into law this week, would nearly double the IRS’ budget, appropriating an additional $79 billion to the agency over the next decade.

“The idea that they’re going to open things up and go after these big billionaires and large corporations is quite frankly bulls–t,” Henck told FOX Business in an interview. “It’s not going to happen. They’re going to give themselves bonuses and promotions and really nice conferences.”

“The big corporations and the billionaires are probably sitting back laughing right now,” he continued.

Henck added that he thought it was “insane” to double the agency’s budget. He said the IRS will target businesses who don’t have enough money to hire Washington lobbyists.

Americans with an annual income of less than $75,000 would be subject to nearly 711,000 new IRS audits under the legislation, according to a House GOP analysis that used historic audit rates. By comparison, individuals making more than $500,000 will receive about 95,000 additional audits as a result of the Inflation Reduction Act.

However, IRS Commissioner Charles Rettig pushed back on reports of new audits, saying “audit rates” would remain the same and that the bill was “absolutely not about increasing audit scrutiny on small businesses or middle-income Americans.” White House press secretary Karine Jean-Pierre told reporters last week that there would be no new audits for people making less than $400,000 per year.

“There will be considerable incentive to basically to shake down taxpayers, and the advantage the IRS has is they have basically unlimited resources and no accountability, whereas a taxpayer has to weigh the cost of accountants, tax lawyers — fighting something in tax court,” Henck told FOX Business.