The ‘entire narrative about inflation being caused by supply chains was just wrong,’ says one economist.

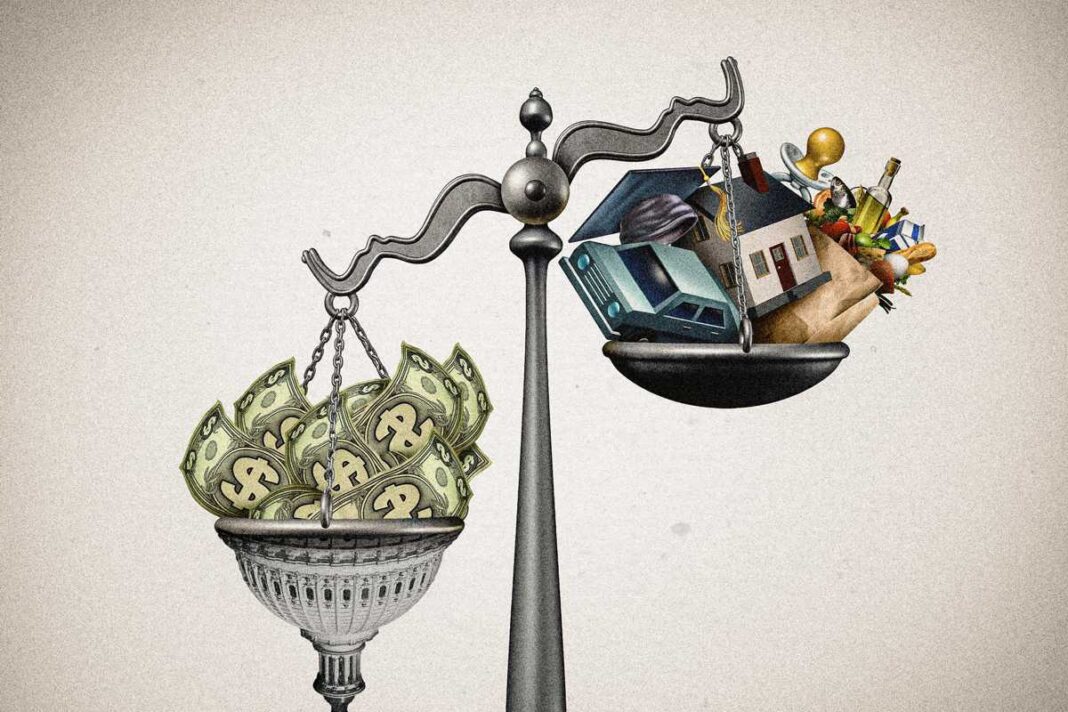

The U.S. dollar has lost 20 percent of its value during the past four years, making inflation one of the top issues cited by Americans in this year’s elections. While inflation has slowed significantly since 2023, it has crept back up by 0.3 percent in November, indicating that the threat has receded but not gone away.

Some have blamed inflation on supply shortages due to the pandemic and Russia’s invasion of Ukraine; and still others point to corporate greed taking advantage of crises to make excessive profits.

However, two recent reports from the Federal Reserve undermine these arguments.

The Fed’s November report regarding its Global Supply Chain Pressure Index (GSCPI), which tracks a number of factors including shipping, airfreight, and other transportation costs, suggests that while supply chain disruptions did cause shortages within certain industries, they were not the primary drivers of overall inflation.

The GSCPI supply chain report showed that the index spiked in 2020 and again in 2021, which coincides with government lockdowns in response to the COVID-19 pandemic.

Russia’s invasion of Ukraine in February 2022 coincided with another increase in supply chain stress, seemingly lending credence to the “Putin price hike,” as Biden called it in a 2022 post on social media platform X.

The GSCPI fell sharply again two months later, however, and has been trending in negative territory for most of the past two years. This indicates that supply chains had recovered by the start of 2023 and have generally been in better shape than before the pandemic ever since.

But while official inflation indicators slowed from a peak of 9 percent in 2022 to 2.7 percent in November, prices have continued to rise.

“Constrained supply chains are not a reasonable explanation because prices did not return to trend as output recovered,” Peter Earle, senior economist at the American Institute for Economic Research, told The Epoch Times. “Nominal spending continues to surge, indicative of a demand side issue.”

EJ Antoni, an economist at the Heritage Foundation, likewise argued that while supply chain interruptions caused prices to go up temporarily in certain industries, such as automakers, they fail to explain persistent and widespread inflation.

The GSCPI data, he said, “speaks to why that entire narrative about inflation being caused by supply chains was just wrong.”