CBO released its score of Biden’s bill and it finds that, contrary to what the Democrats asserted (and then un-asserted), the bill would not fully pay for itself.

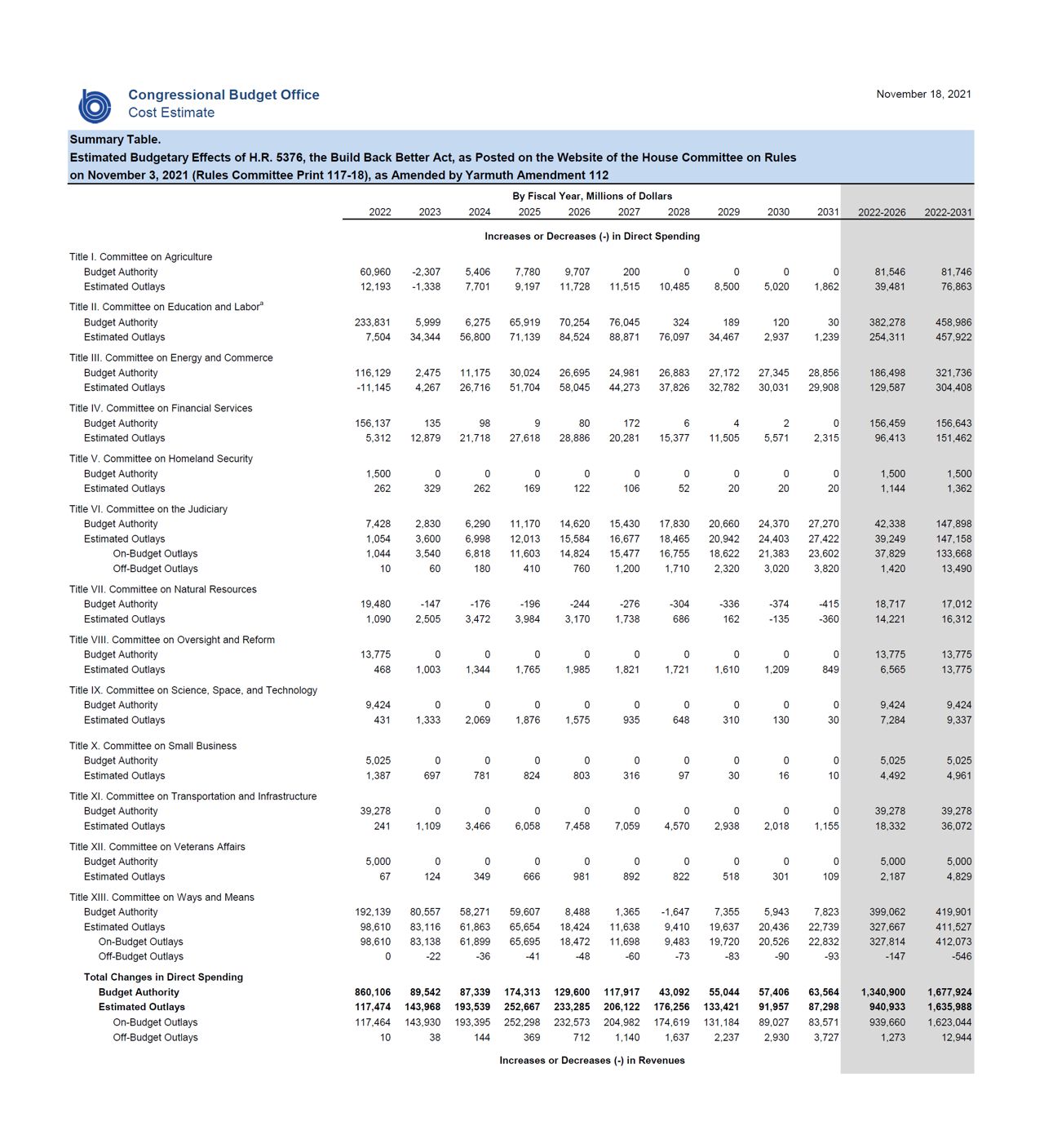

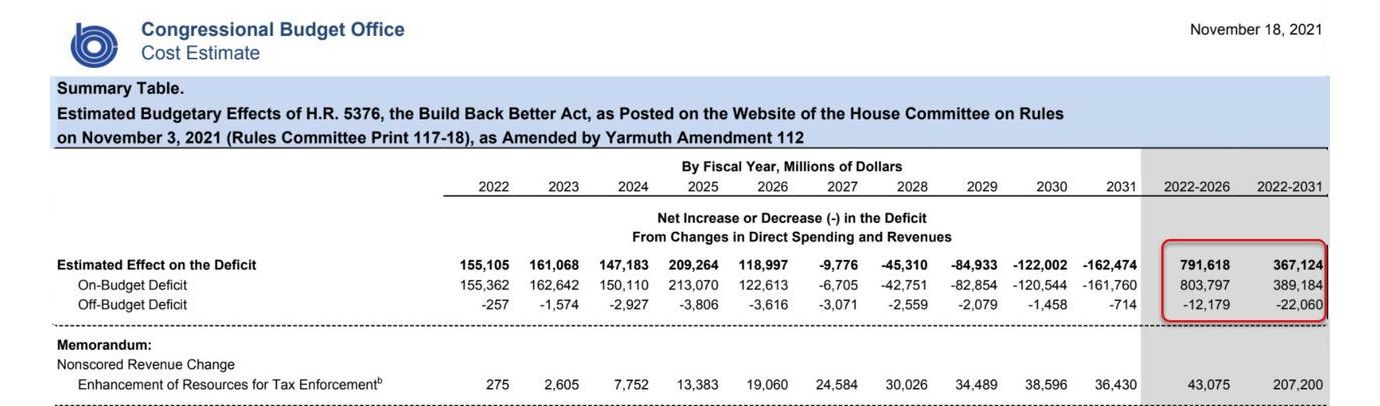

Instead, the CBO estimates that enacting this legislation would result in a net increase in the deficit totaling $367 billion over the 2022-2031 period, as a result of an additional $1.636 trillion in additional spending.

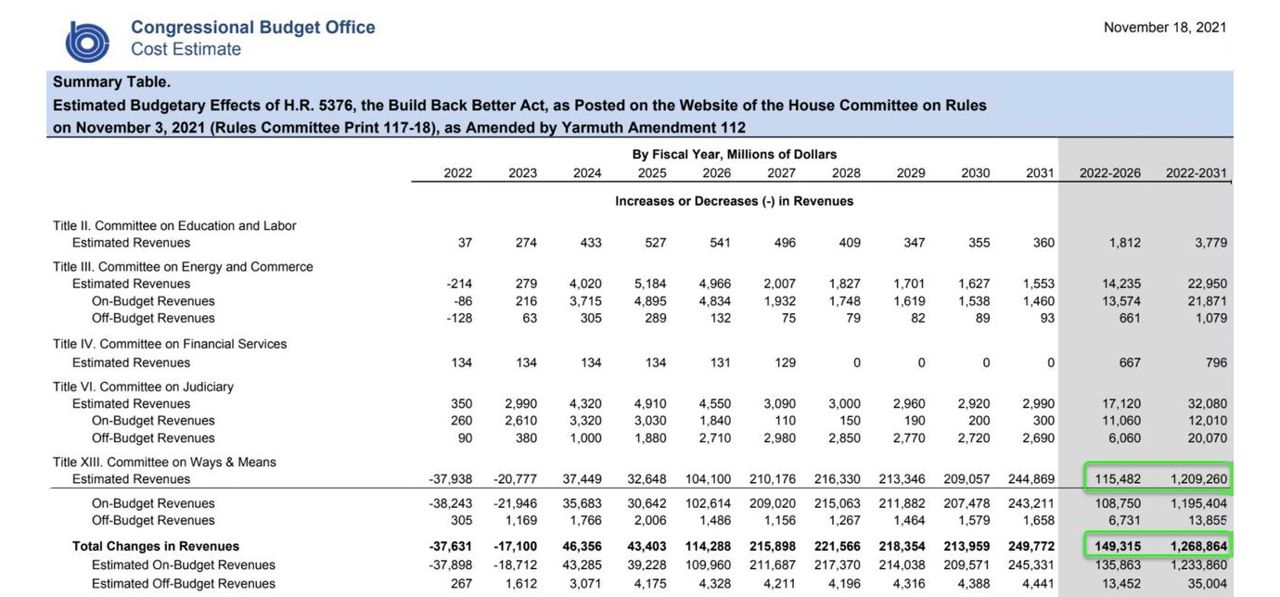

… offset by just $1.269 trillion in revenue (which however the CBO notes does not count any additional revenue that may be generated by additional funding for tax enforcement).

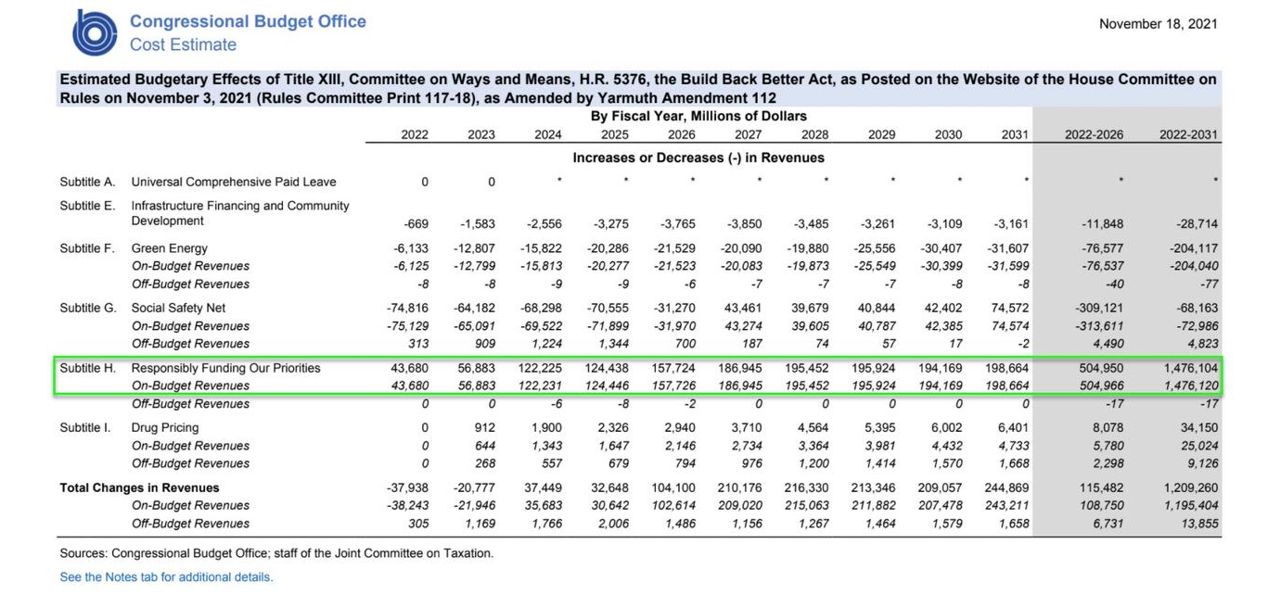

Worse, over just the next five years, the deficit grows by $792 billion, a number which somehow declines to $367 billion over the next decade, which comes as a result of a massive surge in revenues generated from Ways and Means, which magically surges from just $115BN over the next five years to a whopping $1.2 trillion over the next decade.

The massive surge in revenues from Ways and Means comes almost entirely from one section: “Responsibly Funding Our Priorities” (which conjures up an additional $1 trillion of revenues from 2026-2031, dramatically easing the ‘cost’ of the bill)…

That “Responsibly Funding Our Priorities” Section can be read in full here and below (Spoiler Alert – that’s where all the Tax Reform gotchas are).

As Mike Shedlock notes, the 10-year lie is that Progressives say the front-loaded benefits will expire. Meanwhile they pledge to do everything in their power to ensure they don’t.

History shows that government entitlement programs only get bigger, they don’t expire.

Nor did the CBO look at ancillary costs such as inflation.

Earlier in the week, the Biden administration began preparing lawmakers for a ‘disappointing estimate,’ and told them to “disregard” the assessment according to the New York Times.

Hilariously, at just the same time as the CBO revised its long-awaited score, Janet Yellen – knowing how ugly it would look when the CBO scored that the Democrats lied – issued a statement saying that “the combination of CBO’s scores over the last week, the Joint Committee on Taxation estimates, and Treasury analysis, make it clear that Build Back Better is fully paid for, and in fact will reduce our nation’s debt over time by generating more than $2 trillion through reforms that ask the wealthiest Americans and large corporations to pay their fair share.”

The wildcard? Yellen’s estimate that the IRS will recoup “at least $400 billion in additional revenue” from high-earners to plug the hole.

A particularly salient aspect of the revenue raised by the legislation is a historic investment in the IRS to crack down on high-earners who avoid paying the taxes that they owe, which Treasury estimates would generate at least $400 billion in additional revenue.

The CBO somewhat agrees with this hypothetical wildcard which can not be modeled out and instead has to be taken as faith, which is why the CBO did not account for it, but it does say that its deficit estimates do not account for the $207 billion in IRS “savings”, meaning CBO’s effective estimate is $160 billion in new deficits.

Of course, in the end all of this is just optics and the CBO score won’t have any impact, with the Bill sure to pass the House and then it will be up to the moderate Democrats in the Senate to determine if it becomes law.

Now let’s see what moderate Senate Democrats Joe Manchin and Kyrsten Sinema have to say about it.

Summary of Cost Estimate for H.R. 5376, the Build Back Better Act PDF

hr5376_SummaryTableSubtitle I – Responsibly Funding Our Priorities

SubtitleISxSBY Tyler Durden

Read Full Article on ZeroHedge.com