Is the Fed trying to wean the markets off monetary policy? Such was an interesting premise from former British diplomat Alastair Crooke via the Strategic Culture Foundation, to wit:

“The Fed however, may be attempting to implement a contrarian, controlled demolition of the U.S. bubble-economy through interest rate increases. The rate rises will not slay the inflation ‘dragon’ (they would need to be much higher to do that). The purpose is to break a generalised ‘dependency habit’ on free money.”

That is a powerful assessment that, if true, has an overarching impact on the economic and financial markets over the next decade. Such is especially important when considering the effect these repeated monetary and fiscal interventions have had on financial market returns of the previous decade.

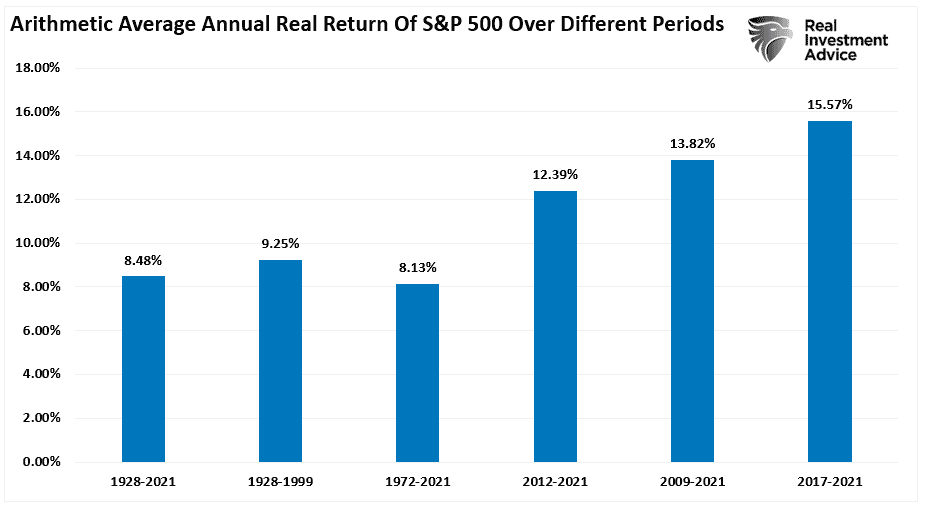

The chart below shows the average annual inflation-adjusted total returns (dividends included) since 1928. I used the total return data from Aswath Damodaran, a Stern School of Business professor at New York University. The chart shows that from 1928 to 2021, the market returned 8.48 percent after inflation. However, notice that after the financial crisis in 2008, returns jumped by an average of four percentage points for the various periods.

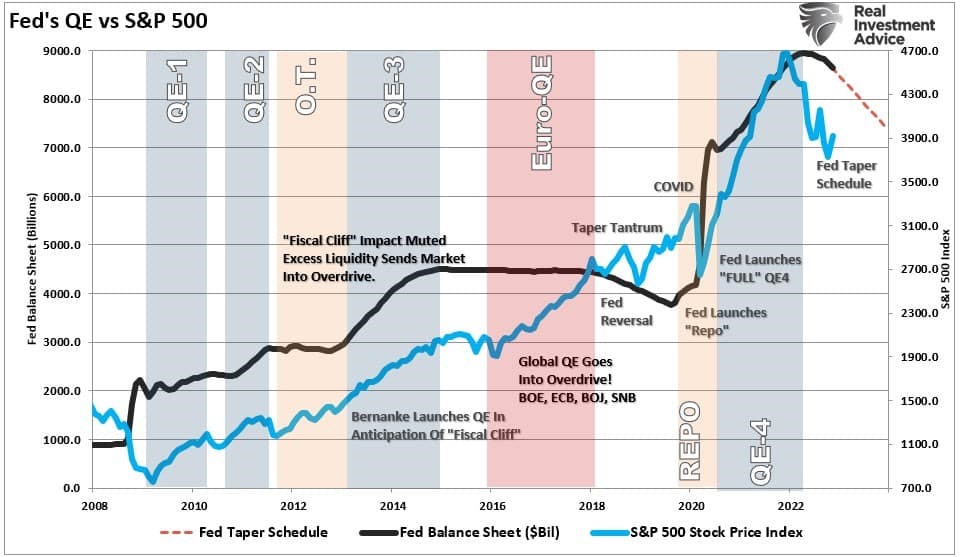

We can directly trace those outsized returns back to the Fed’s repeated monetary and the government’s fiscal policy interventions during that period. Following the financial crisis, the Federal Reserve intervened with monetary support each time the market stumbled or threatened the “wealth effect.”

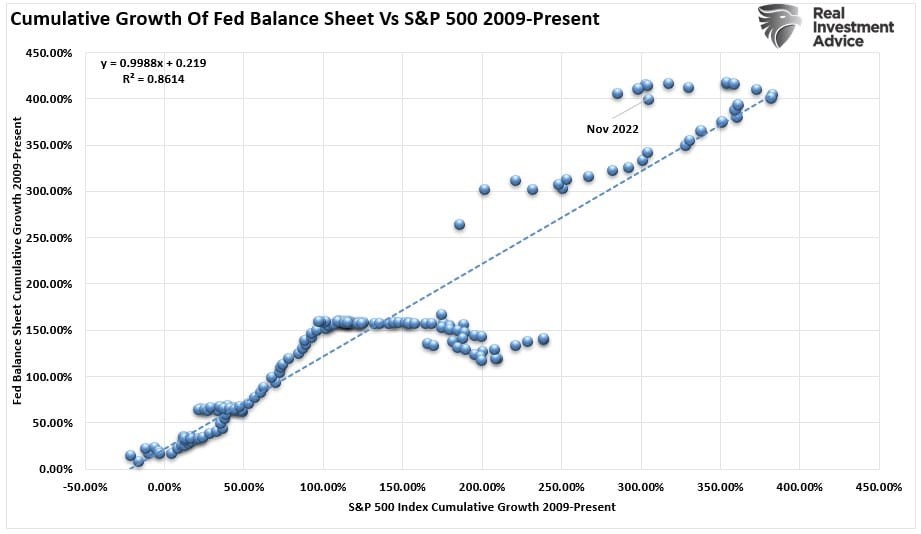

While many want to suggest the Federal Reserve’s monetary interventions do not affect financial markets, the correlation between the two is extremely high.

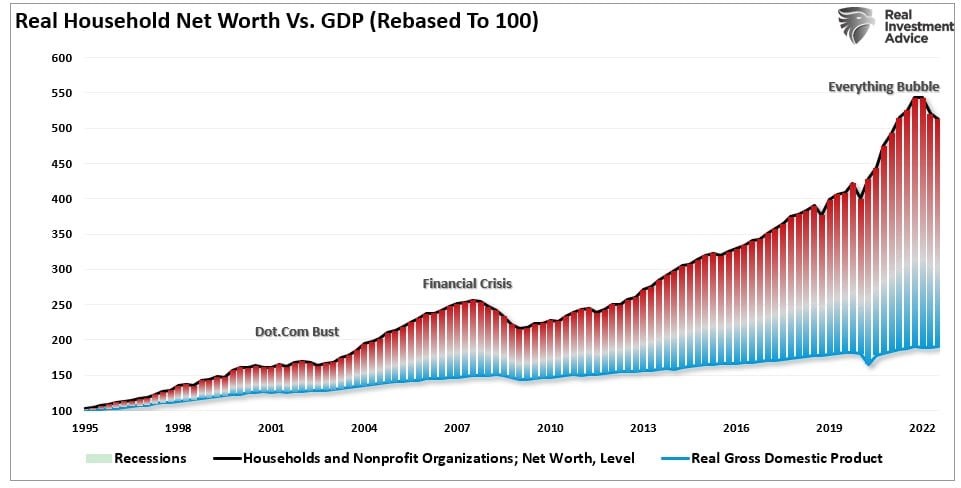

However, the result of more than a decade of unbridled monetary experiments led to a massive wealth gap in the U.S. economy which has become front and center of the political landscape.

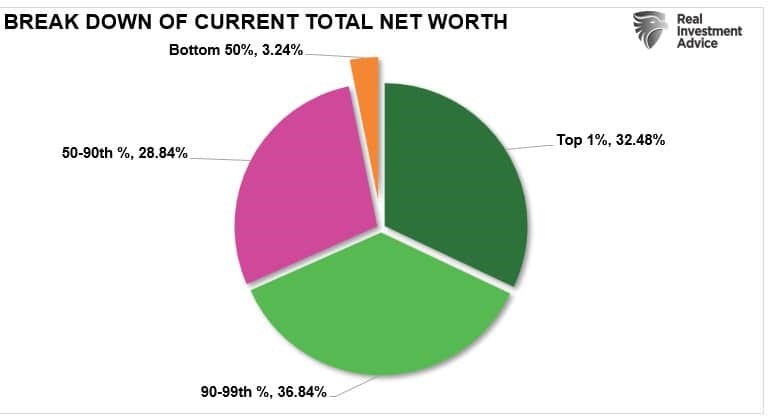

It isn’t just the massive expansion in household net worth since the financial crisis that is troublesome. The problem is that nearly 70 percent of that total household net worth is concentrated in the top 10 percent of income earners.

While it was likely not the Fed’s intention to cause such a massive redistribution of wealth, it was the goal of its grand monetary experiment.