While officials say they’re streamlining the country’s notoriously complex tax system, some say a high VAT will hurt low-income households.

Complaints about Brazil’s confusing tax system have spanned decades and multiple administrations.

The latest reforms were passed in December 2023 after nearly five years of debate. They include a value-added tax (VAT) of up to 27.5 percent that will put Brazil alongside Hungary and Sweden as countries with the highest consumption tax rates in the world.

The United States doesn’t have a VAT, but states have a sales and use tax that varies between 0 and 9.5 percent.

Brazil’s VAT tax will begin to be phased in by 2026 and is currently anticipated to take full effect over a seven year period.

The move has drawn mixed reactions from Brazilians, including criticism that a high VAT will deal a harsh blow to the country’s low income earners. Standard VAT rates of around 20 percent aren’t uncommon in European countries, but those nations don’t have the same level of poverty as Brazil.

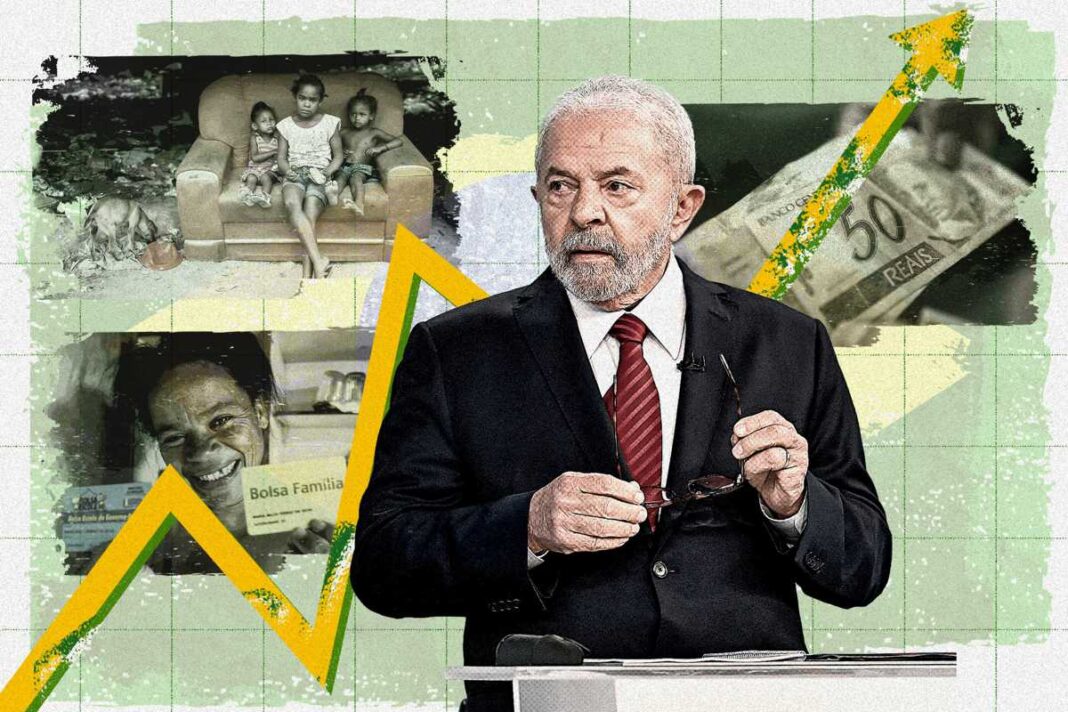

Since leftist President Luiz Inácio Lula da Silva took office in January 2023, his administration has struggled to address inflation and high unemployment, while the poverty rate sits near 30 percent.

Among the new tax reform’s critics is Brazilian Sen. Rogerio Marinho, who said, “We are going to offer Brazil the highest value-added tax in the world.”

Brazil’s current levy aims to consolidate five different consumption taxes into a single VAT to “promote greater efficiency and sectoral isonomy,” according to the Policy Center for the New South.

Supporters of the reform maintain the VAT won’t directly impact Brazilian taxpayers, but experts argue those struggling financially will take a hit regardless.

“It’s clear that Brazil missed a great opportunity to reduce its percentage of tax collection on productive activity, which [will] cause several negative economic consequences,” Paulo Ricardo Alecrim told The Epoch Times.

Mr. Alecrim, a Brazilian tax attorney and a partner at Alecrim & Costa Advogados, says some of the adverse effects of the current reform include increased consumer prices, a chilling effect on consumption, loss of international competitiveness, and a disproportionate impact on the economically vulnerable.