The program is not insolvent, but there’s a growing gap between revenue and expenses. Changing demographics are one big reason.

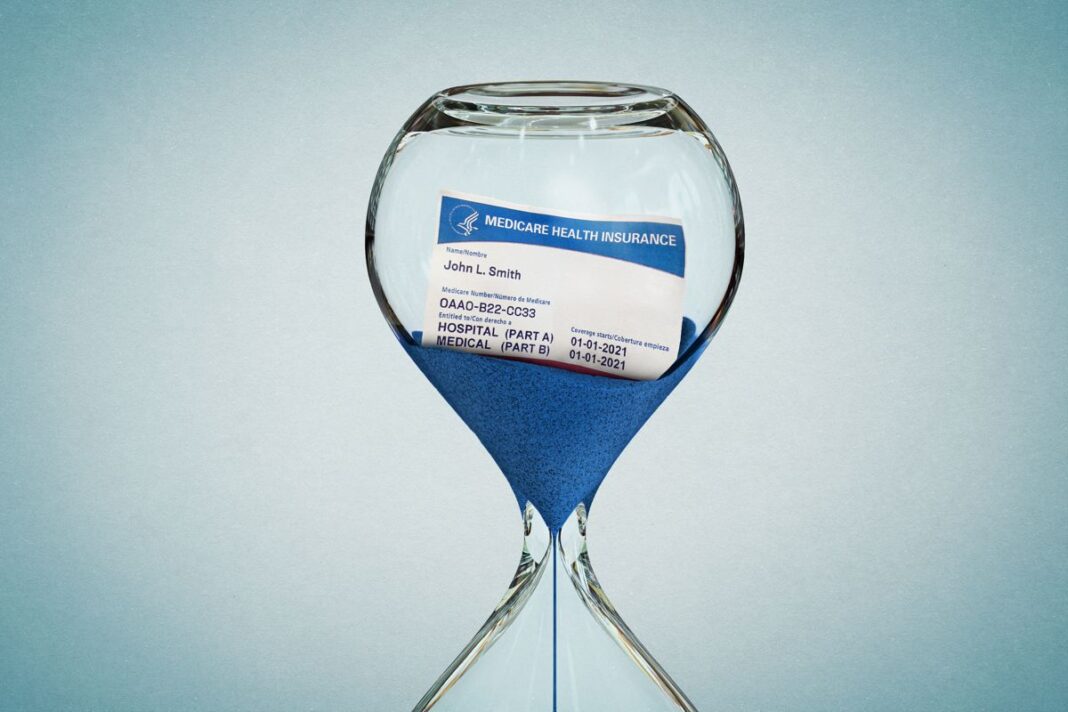

Medicare has a money problem. Or it will in about 10 years. It’s the sort of problem Dwight Eisenhower might have called important but not urgent, like a balloon payment on a mortgage or a roof that only leaks once in a while. Such problems are easy to ignore until it’s too late to fix them.

Yet anything costing $1 trillion a year will inevitably become urgent soon enough, and Medicare’s funding shortfall will demand attention and action by 2036 to prevent a crisis.

That’s when the Hospital Insurance (HI) Trust Fund, which pays hospital bills for 68 million Americans, will be depleted, according to Medicare’s trustees. After that, the annual income for Medicare Part A will fall 11 percent short of expenses.

But that’s a decade away. For now, the HI Trust Fund has a surplus of more than $200 billion, according to the latest report. And Medicare Part B, which covers things such as doctor visits and diagnostic tests, had reserves of over $180 billion.

Medicare is not insolvent, but there is an increasingly large gap between the revenue generated by the program and its total expenses. And that requires an increasingly large transfer of cash from the U.S. Treasury to make the program work.

In 2023, revenue coming into Medicare through payroll taxes, premiums, and interest covered about 57 percent of the program’s expenses. The other 43 percent, about $43 billion, had to be paid from the government’s general fund. This gap between income and expenses has always existed, but it’s growing rapidly. By 2053, the general fund will have to cover fully half of program costs.

President Donald Trump, like former President Joe Biden before him, has promised to protect Medicare, though neither articulated a plan for doing so.

Medicare, which will have its 60th birthday in July, chugged along for decades without attracting much attention. Why is it now falling further and further behind expenses?

That’s partly due to the way Medicare was designed, and it’s partly a result of changing demographics, American innovation, and decisions that were made along the way.