Overview

Elon Musk recently stated that “rich people” should “be caring more” about federal deficits because “if the ship of America sinks,” “we all sink with it.” This may seem like hyperbole, but a widely overlooked report from the U.S. Treasury shows it is a likely scenario unless major changes are made.

The Treasury report, quietly released in January, shows that if the federal government reported its finances in the same manner that large corporations are required by law to report theirs, the primary measure of federal red ink wouldn’t be $36 trillion in national debt but $143 trillion in debts, liabilities, and unfunded obligations.

This staggering figure equals 85% of all the wealth Americans have accumulated since the nation’s founding. It also equates to an average burden of $1.1 million on every household in the nation.

Unlike other measures of federal finances that cover an arbitrary period, extend into the infinite future, or ignore government assets, the figure of $143 trillion applies strictly to Americans who are alive right now and accounts for the value of the government’s commercial assets. Thus, it quantifies the full federal financial burden on today’s Americans.

Complete v. Incomplete Accounting

Federal law requires the U.S. Treasury to publish an annual report that details the government’s “overall financial position.” In addition to the national debt, the “Financial Report of the United States Government” also includes the government’s explicit and implicit financial commitments, such as:

- federal employee pensions and other retirement benefits like healthcare.

- environmental liabilities like contaminated nuclear sites.

- unfunded obligations for social insurance programs like Medicare and Social Security.

Such “fiscal exposures,” as explained by the U.S. Government Accountability Office, “represent significant commitments that ultimately have to be addressed.” Hence, GAO stresses that ignoring them can “make it difficult for policymakers and the public to adequately understand the government’s overall performance and true financial condition.”

Although the Treasury published the report almost two months ago on January 16, Google indicates that no prominent politician or major media outlet has explicitly mentioned it. Meanwhile, the same people have frequently cited the national debt and federal deficit, which are incomplete measures of the federal government’s red ink.

The national debt and federal deficit are mainly based on cash accounting, which is the simplistic process of counting money as it flows in or out. Thus, liabilities like pension benefits for federal workers aren’t measured until they are actually paid, which is often decades after they are promised.

In contrast, the Treasury report mainly uses accrual accounting, which measures financial commitments as they are made. This is how the federal government requires large corporations to report their finances. In the words of the Financial Accounting Standards Board, which is tasked by the U.S. Securities and Exchange Commission to create private-sector accounting rules, accrual accounting is the “most relevant and reliable” way to measure the financial health of pension plans.

The same applies to other retirement benefits like healthcare. The accounting rule that governs such benefits explains that “a failure to accrue” implies “that no obligation exists prior to the payment of benefits.” Since an obligation does exist, failing to account for it “impairs the usefulness and integrity” of financial statements.

The Grand Total

A methodical tally of accrual accounting data in the Treasury report shows that the federal government has amassed $143 trillion in debts, liabilities, and unfunded obligations beyond the value of its commercial assets. This reflects the government’s finances at the close of its 2024 fiscal year on September 30, 2024.

The primary components of this burden, which are unpacked below, include:

- $28.3 trillion in publicly held national debt.

- $17.2 trillion in liabilities that are not accounted for in the publicly held debt.

- $105.8 trillion in unfunded social insurance obligations.

These figures tally to $151.3 trillion in debts, liabilities, and unfunded obligations. Offsetting this is $7.9 trillion in commercial assets owned by the federal government, leaving a grand total shortfall of $143 trillion.

Numbers in the trillions are hard to conceive, so it’s revealing to place them in context. The figure of $143 trillion amounts to 85% of the net wealth Americans have accumulated since the nation’s founding, estimated by the Federal Reserve to be $169 trillion. This includes all of their assets in savings, real estate, corporate stocks, private businesses, and even consumer durable goods like automobiles and furniture.

The government’s $143 trillion shortfall also amounts to:

- $421,108 for every person living in the U.S.

- $1,085,022 for every household in the U.S.

- 4.9 times annual U.S. economic output (GDP).

- 28 times annual federal revenues.

Publicly Held Debt

The simplest major item quantified by the Treasury report is the publicly held debt, which is $28.3 trillion. This is the money the federal government owes to non-federal entities like individuals, corporations, state governments, and foreign governments.

Publicly held debt is a partial measure of the national debt that excludes $7.1 trillion the federal government owes to federal programs like Social Security and Medicare. The Treasury report also details these intergovernmental debts and consolidates them with the items below.

Liabilities

Pension and other retirement benefits are a large part of compensation packages for government employees. With these generous benefits included, civilian non-postal federal employees receive an average of 17% more total compensation than private-sector workers with comparable education and work experience. Postal workers receive even greater premiums ranging from 25% to 43%.

In 2023, federal, state, and local governments spent $2.4 trillion on employee compensation, costing each household in the nation an average of $18,328.

The Treasury report shows that the federal government currently owes $15.0 trillion in pensions and other benefits to federal employees and veterans that are not accounted for in the publicly held national debt. To pay the present value of these benefits will require an average of $113,451 from every household in the United States.

The Treasury reports other liabilities of the federal government, such as:

- $134 billion in accounts payable.

- $666 billion in environmental and disposal liabilities.

- $106 billion in insurance and guarantee program liabilities.

Altogether, the Treasury records $17.2 trillion in liabilities that are not accounted for in the publicly held debt.

Social Security & Medicare

A similar but far more expensive situation exists with social insurance programs like Social Security and Medicare. This is because—contrary to popular belief—these programs don’t save workers’ taxes for their retirements. Instead, they immediately spend the vast majority of those taxes to pay benefits to current recipients. Thus, they are called “pay-as-you-go” programs.

In stark contrast, the U.S. Bureau of Economic Analysis explains, “Federal law requires that private pension plans operate as funded plans, not as pay-as-you-go plans.” The reasons for this, as explained by the American Academy of Actuaries, are to increase “benefit security” and ensure “intergenerational equity.”

Social Security and Medicare, on the other hand, have levied multiplicatively higher tax burdens on succeeding generations of Americans, thus creating severe generational inequity. And unless retirement ages are raised or benefits are reduced in some other way, taxes will need to be increased again to keep the programs solvent.

Musk recently referred to this situation when he called Social Security the “biggest Ponzi scheme of all time” and said, “When you look at the future obligations of Social Security, the actual national debt is like double what people think it is because of the future obligations.”

Federal actuaries measure the unfunded obligations of Social Security and Medicare in several different ways, but only one of them approximates accrual accounting. This is called the “closed-group” unfunded obligation, which is the money needed to cover the shortfalls for all current taxpayers and beneficiaries in these programs.

In the words of Harvard Law School professor and federal budget specialist Howell E. Jackson, the closed-group measure “reflects the financial burden or liability being passed on to future generations.” These burdens are $49.8 trillion for Social Security and $53.9 trillion for Medicare. Placing these figures in context:

- Social Security’s unfunded obligations amount to an additional $272,237 from every person who currently pays Social Security payroll taxes.

- Medicare’s unfunded obligations amount to an additional $201,932 from every U.S. resident aged 16 or older.

Those shortfalls are what remain after the federal government has paid back with interest all of the money it has borrowed from Social Security and Medicare.

Social Security and Medicare differ from true pensions because taxpayers don’t have a contractual right to receive these benefits. Nevertheless, paying these benefits is an implied commitment of the federal government, and federal law requires that these programs be included in the Treasury report.

The Treasury report estimates that the combined closed group unfunded obligations of Social Security, Medicare, and some smaller social insurance programs are $105.8 trillion. This figure doesn’t include intergovernmental debt, which is consolidated with other data in the report.

Federal Assets

The Treasury also records the federal government’s commercial assets, such as:

- $1.2 trillion in cash and other monetary assets.

- $1.3 trillion in property, plants, and equipment.

- $1.8 trillion in receivable loans, mainly comprised of student loans.

In total, the government estimated that it owned $5.7 trillion in commercial assets at the close of its 2024 fiscal year. This figure is likely lower than reality because the Treasury report measures the value of the federal government’s:

- gold and silver according to laws that require it to assess gold at $42.22/ounce and silver at $1.29/ounce, which are small fractions of the market prices.

- property, plant, and equipment at the cost of purchasing these items and then depreciates them, which fails to account for inflation and the appreciation of assets like land.

Using data on the market value of gold and silver and an extremely rough, non-generalizable estimate of the difference between the historical cost and fair market value of a government entity, Just Facts estimates that the federal government has about $2.2 trillion more in assets than the Treasury reported. Including this, the federal government has about $7.9 trillion in commercial assets.

The Treasury report doesn’t account for federal stewardship land and heritage assets, such as national parks and the original copy of the Declaration of Independence. While these items have tangible value, the report explains that they “are intended to be preserved as national treasures,” not sold to the highest bidder to cover debts.

Adding up the federal government’s debts, liabilities, and unfunded obligations and then subtracting the value of its commercial assets yields a fiscal shortfall of $143 trillion.

Root Causes

As with other policy issues, the media and politicians have repeatedly misinformed the public about the root causes of the federal government’s fiscal deterioration.

For example, Congresswoman Jasmine Crockett (D–TX) claims there’s “not” a “lot” of “waste, fraud and abuse in the federal government.” In reality, the Government Accountability Office estimates that the federal government loses $233–$521 billion per year to “fraud alone.” This costs every household in the nation an average of $137,000–$305,000 over a lifetime, not counting waste or abuse.

Those numbers show that if the bulk of fraud were eliminated, it could put a significant dent in the problem, but it would not be nearly enough to fix it.

Another recent example of misinformation comes from PolitiFact, which claims that “tax cuts were the biggest of four types of legislation that have added to the federal debt since 2001.” PolitiFact bases this assertion on a study that puts all tax cuts into one bucket while splitting added spending into three buckets. Placing the added spending into one bucket, the study shows that it accounts for 61% of the added debt.

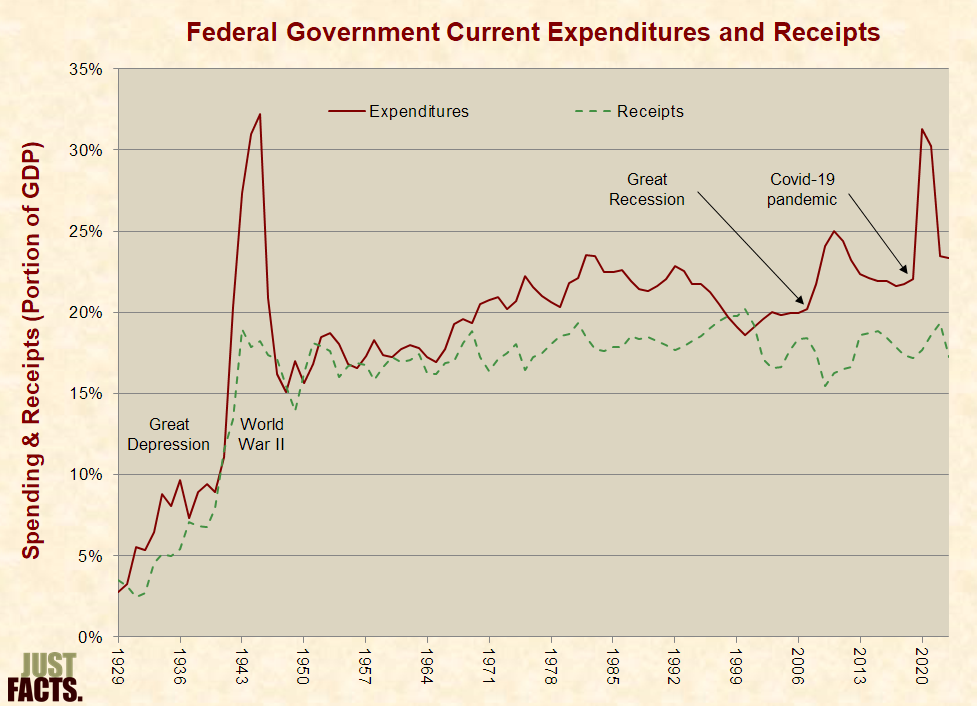

Furthermore, the study states that those figures fail to account for the “effects of the built-in spending growth in certain parts of the budget, while it takes for granted the built-in growth in revenue.” Because such revenue increases are baked into federal law, most “tax cuts” are actually “tax evens” that correct for bracket creep, which consumes an ever-growing share of people’s incomes over time. That’s why despite the passage of numerous “tax cuts,” the portion of the U.S. economy consumed by federal taxes has been roughly level for eight decades:

Meanwhile, federal spending has soared from 3% of the U.S. economy in 1930 to 23% in 2023. Yet, a scientific survey commissioned in 2020 by Just Facts found that 25% of voters believe tax cuts were the main driver of debt. This accords with numerous news stories that blame the debt on tax cuts.

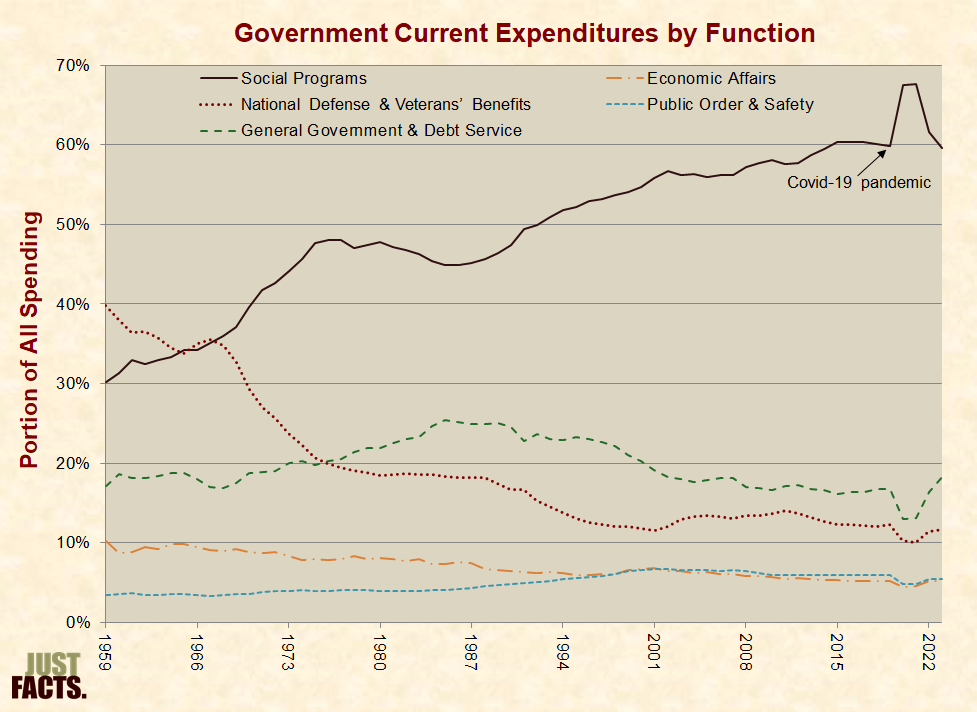

The same survey found that another 25% of voters believe the main driver of rising national debt is military spending. This conforms to the reporting of media outlets that frequently blame the debt on military spending. In reality, military spending has plummeted from 53% of all federal expenses in 1960 to 17% in 2023:

As shown in the charts above, the primary driver of the national debt is increased spending, particularly on social programs. These programs—which provide healthcare, income security, education, nutrition, housing, and cultural services—have grown from 21% of all federal spending in 1960 to 61% in 2023. Yet, only 39% of voters correctly identify social spending as the primary cause of rising debt.

In total, social programs and interest on the national debt—which mainly stems from social programs—account for 75% of all federal spending. Also, the vast bulk of the government’s unfunded obligations are due to Social Security and Medicare.

The Congressional Budget Office projects that the main drivers of future debt will be Social Security, Medicare, Medicaid, the Children’s Health Insurance Program, Obamacare, and interest on the national debt. Under the weight of these, the publicly held debt is due to skyrocket to unprecedented levels over coming decades.

Harmful Effects

The national debt doesn’t always manifest in the obvious fallouts of increased taxes or reduced government benefits. A broad range of academic publications document that the consequences of excessive government debt also include intensified inflation, lower wages, weak economic growth, and combinations of such results.

The linkage between those economic scourges and government debt are not always obvious to voters, and politicians who run up debt often blame “greed” for the harms that their deficit spending has caused. The media also promotes this false storyline. Hence, the harmful effects of government debt continue.

Contrary to those who allege that the U.S. government can spend and borrow with abandon because it can print money, the Government Accountability Office warns that “the costs of federal borrowing will be borne by tomorrow’s workers and taxpayers,” which “may reduce or slow the growth of the living standards of future generations.”

Such effects may have already begun. Although association does not prove causation, the national debt has risen steeply over recent decades, and with this, the U.S. has experienced episodes of rapid inflation and historically poor growth in gross domestic product, productivity, and household income.

James D. Agresti is the president of Just Facts, a research and educational institute dedicated to publishing facts about public policies and teaching research skills.