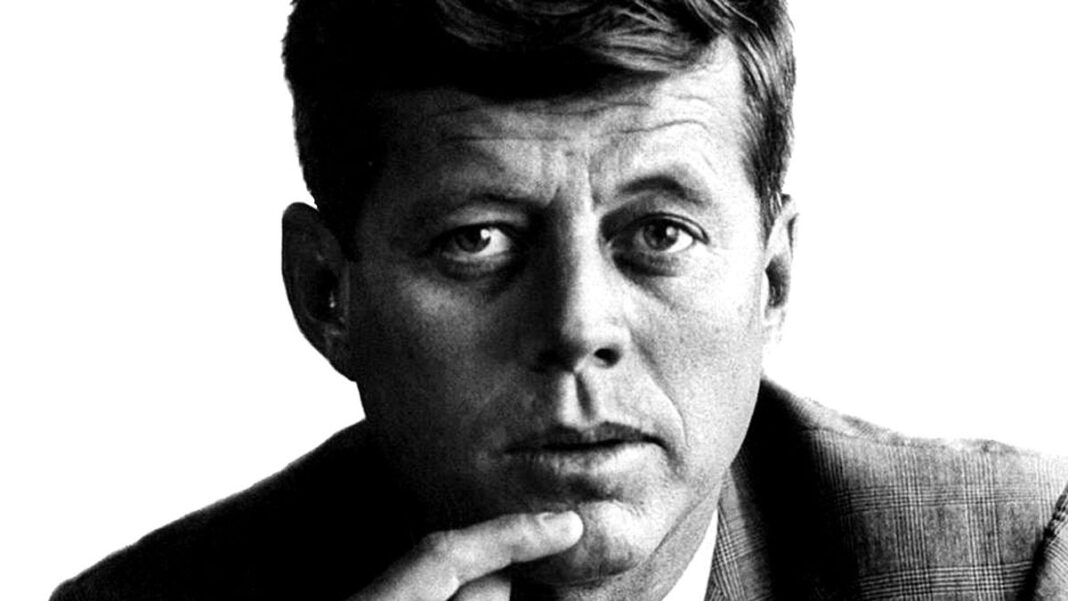

This is a speech given by Senator John F. Kennedy, to the Associated Business Publications Conference, Biltmore Hotel, New York, NY on October 12, 1960.

I want to talk with you today about American economic policy. No topic could be of more importance at this or any other time. Unless the economy is functioning properly, our people will not be employed at good wages, our businessmen will not produce efficiently and profitably, our farmers will not receive fair prices, and our Nation will lack funds for defense, schools, roads and other public services, and the means to help strengthen the cause of world freedom.

Today, as never before, America needs a strong economy – not only to sustain our defenses – but also to demonstrate to other nations – particularly those wavering between our system and the Communists – that the way of freedom is the way to strength and security – that their future lies with us and not with the Soviet Union. That is the basic issue of 1960-and that is why each candidate must make clear his views on economic policy.

I do not know whether to regard with alarm or indignation the common assumption of an inevitable conflict between the business community and the Democratic Party. That is one of the great political myths of our time, carefully fostered. The business community has well served the Democratic Party – and I believe the Democratic Party has well served the business community. Ours is a national party. It draws its support from all segments of the community. Over the years it has benefited greatly by the public and political service, support, advice and assistance of American business leaders. As the party’s standard bearer today, I need – and I ask – the suport and help of our businessmen, and I would do the same in a new Democratic administration. It will not be a businessmen’s administration but neither will it be a labor administration – or a farmers’ administration. It will be an administration representing, and seeking to serve, all Americans.

Just as the Democratic Party has benefited from the contributions of business leaders, so has the business community benefited from the contributions of business leaders, so has the business community benefited from the contributions of the Democratic Party.

And I also believe that the business community – and our basic economic system – have well served the American people. They have provided a very large proportion of our people with a very high and constantly improving standard of living. They have provided the sinew and sustenance to make us the first nation of the world. They have brought a wide array of modern goods within the income of most of our people.

In short, why should my party, if successful, want to change the fundamental structure of a system which has performed so well? Where the performance is inadequate, we would hope to improve it. Where there are economic injustices, we would hope to correct them.

But this would be basically true regardless of who wins. No President – Democratic or Republican – will be satisfied with growing unemployment, lagging economic growth or excessive price inflation that adversely affects our trade with other nations as well as our stability here at home.

And both candidates are also equally opposed to excessive, unjustified or unnecessary government intervention in the economy – to needlessly unbalanced budgets and centralized government. I do not believe that Washington should do for the people what they can do for themselves through local and private effort. There is no magic attached to tax dollars that have been to Washington and back.

In short, big government is not an issue – not at a time when the party which last made it an issue has expanded the Federal payroll to an all-time high, operated at an $18 billion deficit, increased the debt limit five times, caused the highest peacetime deficit in the history of the United States, and spent two-thirds as much money as all of the previous administrations put together.

I do not believe in big government – but I believe in effective government – in a government which meets its appropriate responsibilities, and meets them effectively. Economic policy can result from governmental inaction as well as governmental action. What you are entitled to hear from me is: Why is a change necessary – and what changes would I adopt?

I start from the premise that the performance of the Republican Party has been inadequate in at least five areas of economic policy.

1. The first and most comprehensive failure in our performance has been in our rate of economic growth. From 1953 until the end of last year, our average annual increase in output – the real rate of growth – has been only 2.4 percent per year. The rate of increase in the Soviet Union, on the testimony of Mr. Allen Dulles, of the CIA, has been better than 7 percent.

It is easy to juggle these figures, or dismiss them as “growthmanship.” It is easy to say that comparisons with the Soviet Union are not valid, because of the difference in base and method. But the fact remains that our growth rate is too low – that it was higher in the years 1947 to 1953 – and I think this is perhaps of most significance – that it is below that not only of the Soviet Union but of the more mature industrialized economies of Western Europe and Japan, Germany, France, and Italy. That should concern us all.

2. My second concern is unemployment. Between November 1957 and August 1960 the rate of jobless workers, seasonally adjusted, has been below 5 percent of the labor force in only 3 months out of 34. Last month it was 5.9 percent. Adding those who are on short time, this means that the total of unemployment and underemployment is not less than 7 percent of the labor force. And in some areas – in Detroit, San Diego, in steel, coal, and textile towns – the proportion is much higher.

3. Third, I am concerned about the periodic recurrence of recessions. There have been two recessions since 1952 and, as the Wall Street Journal has warned, a third could now be underway. During a recession, as unemployment rises, profits decline, and farmers and small businessmen suffer especially, the growth of the gross national product slows to a halt, and public revenues shrink. A free economy cannot have a perfectly regular rate of growth. But we cannot continue to view these sharp periodic setbacks with equanimity when we could ease their severity and slow their duration.

4. I am concerned with the steady upward drift in prices since World War II. Industrial prices have been stable only during weak spots – the 1953-54 and 1957-58 recessions and the recent months of downward drift. The Consumers’ Price Index would have risen even more sharply if farm prices had not declined during the same period. During the decade of the 1950’s, industrial prices increased, on the average, nearly 30 percent – some increasing still more. Steel prices, for example, have been approximately doubling themselves every decade.

I believe that reasonable stability in the price level is a vital goal of economic policy. By pursuing this goal we keep faith with those who save; we protect those who live on a fixed income; and we build world confidence in the soundness and integrity of the dollar. It is equally urgent that we do not achieve this kind of stability at the expense of any one group in the economy, such as farmers – or at the price of recessions, unemployment, and stagnation. I believe we can keep our prices stable while maintaining higher and more stable levels of production and employment.

5. Finally, there is proper concern about our balance of payments and the recent drain of gold. It is vital that we keep our exports well ahead of our imports in order to cover our commitments abroad – our military forces around the world, our diplomatic obligations, our military aid, and our assistance to underdeveloped nations. But there is still no substitute – for the Nation as well as the individual – for a good cash position; and the difference between our exports and imports today (although somewhat better than last year) is still not enough to meet our obligations around the world.

It is in these five areas of concern – economic growth, unemployment, the business cycle, price stability, and our balance of payments – that I think we can do better, that I think we must do better. And I believe that most businessmen share my concern – and share my belief that we can do better.

What changes are needed? What policies would be successful?

First, a Democratic administration would use monetary policies more flexibly than the Republicans. The Republicans adopted the seemingly simple and easy policy of tightening interest rates when demand was strong and prices were rising – a principle that requires allowing rates to fall when the economy needed stimulation. But the facts of the matter are that each successive peak and each successive valley in the economy has ended with higher and higher interest rates – with the result that paradoxically high rates accompanied heavy unemployment, low production, and a slack economy.

For this policy has not worked. By periodically cutting back on investment, it has held back on a normal, healthy rate of growth. By staying tight too long, as it did in the fall of 1957 when the storm signals were already flying for the recession of 1958 – by the Federal Reserve Board’s tight credit – by the defense stretchout of 1958 – it helped to bring on that and other recessions. And, by penalizing most those who must borrow from banks for investment or homebuilding, it is weighted in favor of the larger corporations, which have access to the open market or which can invest from their own earnings.

A Democratic administration would not rdy upon lopsided monetary policy. It would maintain greater flexibility for investment, expansion and growth. It would not raise interest rates as an end in itself. Without rejecting monetary stringency as a potential method of curbing extravagant booms, we would make more use of other tools.

Secondly, and in this connection, we would use the budget as an instrument of economic stabilization. I believe that the budget should normally be balanced. The exception apart from a serious or extraordinary threat to the national security is serious unemployment. In boom times we should run a surplus and retire the debt. When men and plant are unemployed in serious numbers, the opposite policies are in order. We should seek a balanced budget over the course of the business cycle with surpluses during good times more than offsetting the deficits which may be incurred during slumps.

I submit that this is not a radical fiscal policy. It is a conservative policy.

But we must have a flexible, balanced and, above all, coordinated monetary and fiscal policy. I do not, let me make clear, advocate any changes in the constitution of the Federal Reserve System. It is important to keep the day-to-day operations of the Federal Reserve removed from political pressures.

The President’s responsibility – if he is to lead – includes longer range coordination an a direction of economic policies, subject to our system of checks and balances. And I believe the Federal Reserve Board – which during the last 8 years has cooperated closely with this administration – would also cooperate with future strong and well considered Presidential leadership which expresses the responsible will of Congress and the people.

Third, I believe that the next administration must work sympathetically and closely with labor and management to develop wage and price policies that are consistent with stability. We can no longer afford the large erratic movements in prices which jeopardize domestic price stability and our balance of payments abroad. Nor is there a place for the kind of ad hoc last-minute intervention which settled the steel strike.

Without resorting to the compulsion of wage or price controls, the President of the United States must actively use the powers of leadership in pursuit of well-defined goals of price stability. For those powers – of reason, moral suasion, and informed public opinion, influencing public opinion – have by no means been exhausted to date.

Fourth, we must make certain that there is proper encouragement to plant modernization. Postwar Europe has a new and modern industrial plant. So has the Soviet Union. We cannot compete if our plants are out of date or second rate. Wherever we can be certain that tax revision, including accelerated depreciation, will encourage the modernization of our capital plant – and not be a disguise for tax avoidance – we should proceed with such revision. It is sound, liberal policy to see that our productive plant is the best and most modern in the world.

And a combination of these policies with policies of full employment can help us realize the full promise of automation. Taxes affect not only revenue but also growth and a new administration must review carefully but with imagination our entire tax policy to see that these objectives are being met.

Fifth, we must pay equal attention to the men that man the plant. Growth requires that we have the best trained and best educated labor force in the world. Investment in manpower is just as important as investment in facilities. Yet today we waste precious resources when the bright youngster, who should have been a skilled draftsman or able scientist or engineer must remain a pick-and-shovel worker because he never had a chance to develop his talents. It is time we geared our educational systems to meet the increased demand of modern industry – strengthening our public schools, our colleges, and our vocational programs for retraining unemployed workers.

Finally, we must remember that, in the long run, the public development of natural resources too vast for private capital – and federally encouraged research, especially basic research – are both sources of tremendous economic progress.

In all of these areas, I believe we can do a better job. If our economy is vigorous, efficient, and expanding, and if our prices are stable and competitive, then business will create the jobs necessary for full employment and recover our old position in world and domestic markets. And as we continue to invest in other countries, other countries I hope will invest here. Our balance of payments will be strong, and we can cease to worry about the outflow of gold. I do not minimize the importance of the outflow of gold, especially in the short run, especially at the present time. And I would never want us in the position of being forced to tinker with the dollar in order to maintain our competitive position in the world export market. Our balance-of-payments position must be recognized in framing our domestic economic policies. It is a problem we must face, with all its implications. It affects our monetary policy as well as our wage and price policy, and they are all affected by our competitive position with the free world, the underdeveloped world, and with the managed economy of the Soviet world itself.

This will involve the policies of other nations as well. For most of the world still relives the days of the dollar shortage. Though it no longer exists, the habit of behaving as though it did exist – of saving dollars by discriminating against American goods – has not yet disappeared. Our goods are still subject to special restrictions in many markets. We must work hard to get these restrictions removed. We should explore market and credit reports as methods of encouraging exports.

And we should work with the creation of the larger trading units in Europe – the Common Market and the free trade area. These will strengthen Europe; they need not divide it. But it is a development of long-range importance to the United States and Latin America. Is there a chance that the trend toward these trading communities is passing us by – that we will awaken one day to find ourselves the great outsider? I would like to be certain that this is not happening.

We must also take a new look at our programs of economic aid. I firmly support such aid – but we must be sure that it is well and efficiently used – and increasingly, we must make assistance to the under-developed nations a cooperative endeavor of the well-to-do developed lands, cooperatively financed, those lands we assisted after World War II.

Here, as so often, economies and economics merge with foreign policy. After World War II the United States could have taken advantage of its extraordinary financial position; but in the interest of the free world we used imagination and restraint. Today, could we not fairly ask our friends to show similar restraint in dealing with gold and in helping to carry, according to their ability, a larger share of the financial burden of defending the free world and aiding the underdeveloped nations?

In this age, when capitalism is on trial, we cannot have a policy that is less than the best. Indeed, we can perpetuate capitalism only by making it work – by serving it as well as it has served us. This, I think, is the economic issue in this campaign.

It is between the contented and the concerned; between the inert and the active; between those who look back in satisfaction and those who look forward with hope. I am proud to be the candidate of the concerned, of the hopeful, and of those who look for progress. I am proud to be the candidate of my party.