Extra revenue created by an estate-planning device that increases the value of a family-held corporation is taxable, the court held.

The Supreme Court ruled unanimously in favor of the IRS on June 6 in a dispute over taxing shareholders’ life insurance policies.

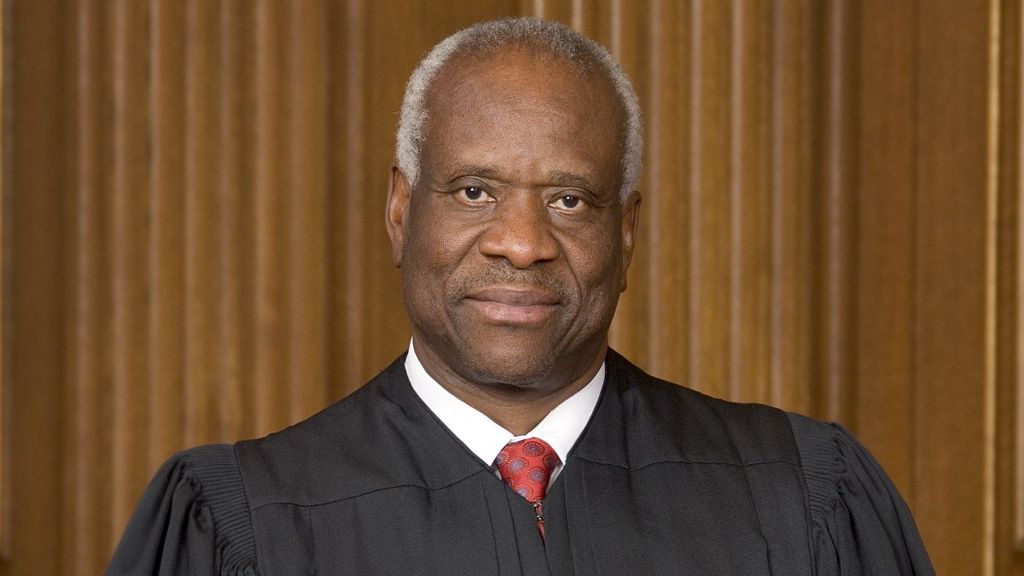

Justice Clarence Thomas wrote the court’s 9–0 decision in Connelly v. Internal Revenue Service.

The case concerns two brothers’ closely held corporation. After one of the brothers died, tax authorities and the estate didn’t agree on the value of the stock.

Closely held corporations commonly enter into agreements that require the redemption of a shareholder’s stock after the shareholder dies to preserve the closely held nature of the business. Under such routine estate-planning devices, corporations purchase life insurance on the shareholder to make sure the transaction is funded.

The Supreme Court held that life insurance proceeds that will be used to redeem a decedent’s shares must be included when calculating the value of those shares for purposes of the federal estate tax.

The appeal of Thomas Connelly, executor of the estate of Michael Connelly, was rejected by the U.S. Court of Appeals for the Eighth Circuit in June 2023.

The IRS said the estate owed close to $1 million after it found that St. Louis-based Crown C Corp., a building materials business, failed to report life insurance proceeds after Michael Connelly died in 2013.

Michael Connelly, who was president and CEO of the corporation when he died, owned 77.18 percent of the company’s shares, while Thomas Connelly owned 22.82 percent.

The executor filed an estate tax return reporting the value of his brother’s shares as $3 million, but the IRS conducted an audit in which an accounting firm valued the shares at more than $3.8 million at the time of the brother’s death.

The IRS determined that the life insurance proceeds needed to be included in the valuation of the corporation, which meant the company had a value of $6.8 million at the date of death. The IRS found that the estate owed an additional $890,000. The estate paid the amount and then sued the tax agency in federal court in Missouri.