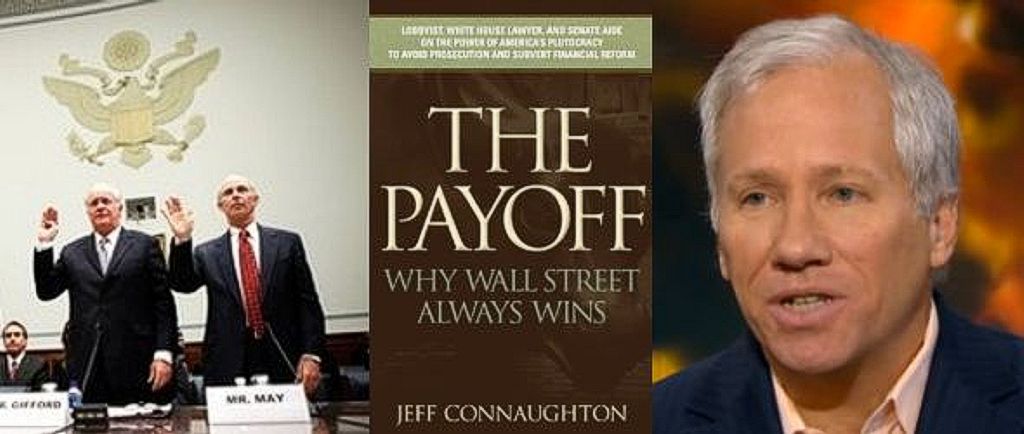

Lobbyist, White House Lawyer, and Senate Aide on the Power of America’s Plutocracy to Avoid Prosecution and Subvert Financial Reform

Publication Date: September 18, 2012

Beginning in January 2009, THE PAYOFF lays bare Washington’s culture of power and plutocracy. It’s the story of the twenty-month struggle by Senator Ted Kaufman and Jeff Connaughton, his chief of staff, to hold Wall Street executives accountable for securities fraud, to stop stock manipulation by high-frequency traders, and to break up too-big-to-fail megabanks.

This book takes us inside their dogged crusade against institutional inertia and industry influence as they encounter an outright reluctance by the Obama administration, the Justice Department, and the Securities and Exchange Commission to treat Wall Street crimes with the gravity they deserve. On financial reforms, Connaughton criticizes Democrats for relying on the very Wall Street technocrats who had failed to prevent the crisis and Republicans for staunchly opposing real reforms primarily to enjoy a golden opportunity to siphon fundraising dollars from the Wall Street executives who had raised millions to elect Barack Obama president.

Connaughton, a former lawyer in the Clinton White House, illuminates the pivotal moments and key decisions in the fight for financial reform that have gone largely unreported. His arch, nonpartisan account chronicles the reasons why Wall Street’s worst offenses were left unpunished, and why it’s likely that the 2008 debacle will happen again.

From the Inside Flap

In January 2009, Ted Kaufman, longtime aide to Vice President Joe Biden, was appointed to fill Biden’s seat in the U.S. Senate. Former Biden staffer and top DC lobbyist Jeff Connaughton joined Kaufman as his chief of staff. Frustrated with the systemic failures that led to a devastating financial crisis, together they led the charge in challenging both Congress and the Obama administration to rein in the excesses of Wall Street.

THE PAYOFF examines a culture of power elites in our nation’s capital that is slouching toward plutocracy, an alarming tale of reformers with the best of intentions running headlong into institutional failure and influence-peddling politics. It’s the story of a twenty-month struggle to hold Wall Street executives accountable for securities fraud, to stop stock manipulation by high-frequency traders, and to break up too-big-to-fail megabanks. In this book, we experience a U.S. senator’s vigorous crusade against Wall Street’s irresponsible risk-taking that destabilized the American economy. Through times of triumph and disheartening defeats, rarely witnessed from within our country’s legislative body, we encounter inertia, behind-the-scenes maneuvering, and outright reluctance by the Obama administration, the Justice Department, and the Securities and Exchange Commission to treat Wall Street crimes with the urgency they deserve. Even Robert Khuzami, director of the SEC’s enforcement division, when asked about federal judges rebuking the SEC for levying paltry fines, said to Kaufman: “I’m not losing any sleep over it.” Meanwhile, the Republican Party remains staunchly opposed to significant financial reform, primarily to wring fundraising dollars from the same Wall Street players who’d raised millions to elect Barack Obama president.

Connaughton, a former lawyer in the Clinton White House, illuminates the pivotal moments and key decisions in the fight for financial reform that have gone largely unreported. His take-no-prisoners, nonpartisan account chronicles the reasons why Wall Street’s worst offenses were left unpunished, why Obama’s Financial Fraud Enforcement Task Force was merely window dressing, why our stock markets are broken, and why it’s likely the 2008 Wall Street–driven debacle will happen again.

Finally, in an incisive self-critique, Connaughton reviews the arc of his own career—from an idealistic Biden acolyte to a money-driven Professional Democrat to Washington critic and commentator—and spells out why all Americans should stand united against crony capitalism.

“[T]here is a new powerful voice who knows how big banks really work and who is willing to tell the truth in great and convincing detail. Jeff Connaughton – a former senior political adviser who has worked both for and against powerful Wall Street interests over the years — has just published a page-turning memoir that is also a damning critique of how Wall Street operates, the political capture of Washington, and our collective failure to reform finance in the past four years. The Payoff: Why Wall Street Always Wins, is the perfect antidote to disinformation put about by global megabanks and their friends.” ~ Simon Johnson, “One Man Against the Wall Street Lobby,” Huffington Post, 8/25/12

Below, Jeff Connaughton, author of “The Payoff: Why Wall Street Always Wins,” discusses the intersection of politics and Wall Street. He speaks with Pimm Fox on Bloomberg Television’s “Taking Stock.” (Source: Bloomberg)