The Rise of New Socialists in the Age of Gilded Subsidies (Part 1)

The 2024 presidential campaign is between two political candidates promising socialism with massive subsidies to corporations, notwithstanding both claiming to be committed capitalists. Harris is promising housing subsidies, paid leave, ACA premium credits, additional childcare tax credits, and the extension of some of the tax credits in Trump’s 2018 Tax Cuts and Jobs Act. While some of her tax cuts would be offset with higher taxes on the wealthy, her promises are estimated to increase deficits by an additional $3.5 trillion.

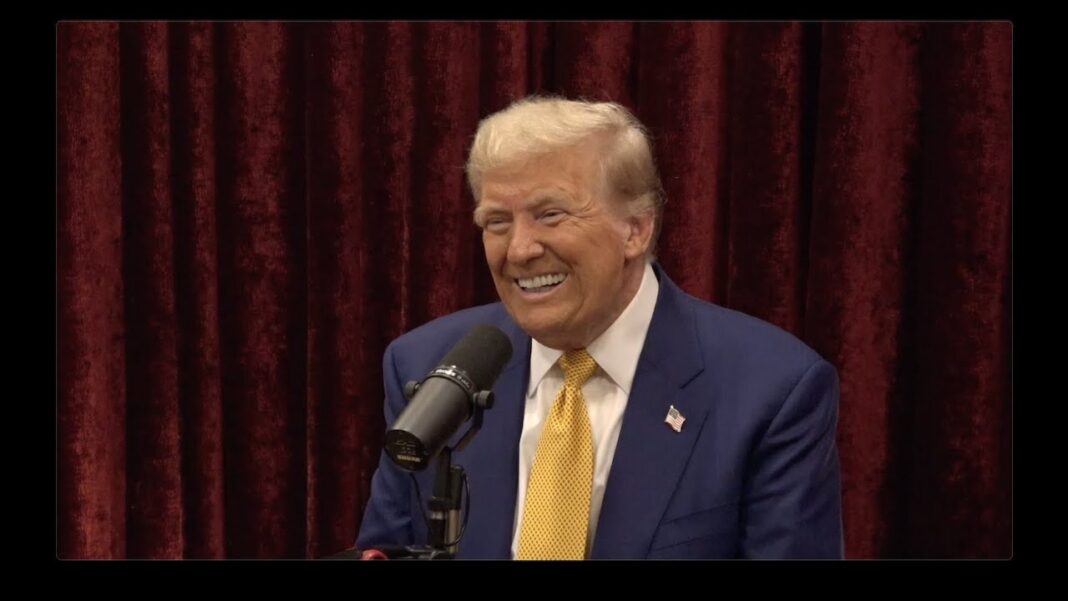

Trump trumps Harris on the giveaways. Trump proposes “No Taxes” on tips, overtime pay, social security benefits, and the extension of his 2018 tax cuts. Trump would offset his tax expenditures by repealing Biden’s clean energy initiatives and imposing tariffs on imported goods. His tax cuts are estimated to increase the deficit by $7.5 trillion.

These new subsidies would be added to the national pile of debt, which exceeds $35 trillion.

Federal government subsidies are offered to the largest corporations, farms, and non-profits to incentivize them to do what the government wants. Tragically, corporations are willing to cede independence and creativity in exchange for federal money that makes their balance sheets shine risk-free. The subsidies increase corporate profits by allowing the recipient to be more competitive, especially against those corporations that do not have access to or are unwilling to accept the subsidies. The process is simple: if a corporation wants the money, it complies with the government’s directives. Part II discusses how these massive federal subsidies have turned the corporate world into a collection of welfare kings.

Part I of this series addressed trillions of federal government subsidies to the medical and university industries.

Corporate subsidies are ubiquitous in federal law. Subsidies are available in almost every area of federal activity, from defense to education, science to social services. The Department of the Treasury identifies 164 tax expenditures for fiscal years 2021 to 2031. The subsidies include grants, tax credits, loan guarantees, and industry bailouts.

Corporate subsidies are deeply entrenched in federal law, yet there are few attempts to put a price tag on these giveaways. A 2012 study by the Cato Institute, “Corporate Welfare in the Federal Budget,” is the last serious effort at calculating the overall financial benefit of the subsidies. Cato estimated corporate subsidies at only $100 billion annually. However, the lack of access to corporate tax returns and the tens of thousands of government grants to corporations makes the actual cost of these subsidies impossible to calculate, highlighting the need for more transparency and accountability.

Since the Cato report, there has been Trump’s 2018 Tax Cuts and Jobs Act, Biden’s Infrastructure Investment and Jobs Act (“IIJA”) and the Inflation Reduction Act (“IRA”). All have dramatically increased government subsidies to corporations. Trump gave subsidies to corporations in the form of a significant cut in the corporate tax rate from 35% to 21% and a shift toward a territorial tax system that exempts foreign income from federal tax. Additionally, it allowed for full expensing of capital investments and provided a 20% deduction from income for pass-through businesses that report income in the same manner as individuals.

Biden’s IIJA contains 452 specific funding sources and gives away $850 billion in construction grants for transportation, energy, water, broadband, and environmental programs. Biden’s IRA gives away hundreds of billions and perhaps trillions of subsidies (tax credits, loans, and loan guarantees) to corporations undertaking the government’s obsession with “climate protection activities.” Goldman Sachs estimates the cost of the subsidies to be $1.2 trillion. A few of the beneficiaries include electric vehicles ($379 billion), energy manufacturing ($156 billion), renewable electricity production ($82 billion), energy efficiency ($42 billion), hydrogen production ($36 billion), biofuels ($34 billion), and carbon capture and storage $31 billion). The Energy Department was authorized to lend up to $400 billion to advance climate projects.

Two “poor” corporations receiving the subsidies are Exxon, valued at $461 billion, which received $7 billion for hydrogen and carbon capture, and Ford Motors, which received a $9.2 billion loan for two battery companies.

Perhaps the most stunning illustration of corporate greed is the oil and gas industries. It is lobbying presidential candidate Trump to maintain the subsidy parts of the Biden administration’s $1.6 trillion climate, energy, and infrastructure agenda that provides $369 billion in subsidies and tax credits for their “clean energy” projects. The oil and gas industries do not support tax credits for electric vehicles since they do not use gasoline. From the Bush administration, until Biden’s subsidies became available, the oil and gas industry opposed almost all proposed climate change laws, regulations, Executive Orders, and proposals. Suddenly, money, money, money makes their principles turn around.

Recently, Constellation Energy announced that it will reopen the infamous Three-Mile Island nuclear plant, known for its 1979 meltdown. The facility will sell its energy to Microsoft’s massive AI data hog facilities. Of course, it will all happen using the corporate tax subsidies of Biden’s IRA. Microsoft has a market cap of $3.1 trillion, and Constellation is valued at $80 billion. The U.S. government is penniless and is $35 trillion in debt. Yet, it finances wealthy corporations.

Then there is the CHIPS Act. It provides a $280 billion gift package to the $3.4 trillion market cap semiconductor industry to build more factories in the U.S. Intel, a company with a $100 billion market cap, was the first to receive $20 billion in subsidies.

In addition, between 2010 and 2019, the pharmaceutical industry received $220 billion. A report from the Institute for New Economic Thinking found that the federal government has funded every new pharmaceutical in the last decade. Moreover, CBO and GAO estimate the industry received between $18 and $23 billion in COVID-19 handouts. One research study puts the number at $39.4 billion. These massive subsidies follow a long history of subsidies, including federal bailouts of railroads, banks, mortgage companies, and automobile manufacturers. The real cause for alarm with corporate subsidies, however, is that politicians and other countries now know American business is “For Sale.” The only thing the buyers, even hostile foreign buyers, need to know is the price.

Like other federal programs, federal farm subsidies are reserved for the rich. Despite hypocritical claims from big businesses that cuts will affect the family farmer, the reality is starkly different. Between 2017 and 2020, federal farm subsidy payments increased from $4 billion to $20 billion. In 2016, 17% of the subsidies went to the top 1% of the farms, and 60% went to the top 10%. By 2019, the wealthiest 1% of the farms received almost one-fourth of the subsidies, and the top 10 percent received almost two-thirds of the total, highlighting the gross disparity in the distribution of these subsidies.

In 2022, the $17.3 billion federal farm insurance program sent $3.7 billion to insurance companies and agents that sell and service its $9.4 billion insurance program.

In 2022, farms received over $22 billion in government payments. These payments helped make the farmer considerably wealthier than the average citizen. The median farm income was $98,148 in 2023, whereas the income of the median U.S. household was around $70,000.

Non-profits are really big businesses disguised as “do-gooders.” A surprising fact is the non-profit world is huge and wealthy. It is 15% of the U.S. Gross Domestic Product. The 1.8 million non-profit organizations manage $8 trillion in assets and produce $238 billion in net income. Many of these non-profits are exempt from federal and State taxes. Some even have a status that allows contributors to deduct contributions given to them. These “poor non-profits” include multi–billion-dollar hospitals, health insurance plans, credit unions, utilities, and universities. Even the multi-billion dollar National Football League had non-profit status until it surrendered it in 2014 due to political pressure.

There are multi-billion-dollar government contractors that have non-profit status.

In this world of “poor non-profits,” only 12% of all charitable organizations rely on charitable donations. The remaining 88% function as businesses. The non-profit hospitals and health insurance plans generate $1.6 trillion in income and earn $61 billion in profits.

The American business community is now so reliant on subsidies that it must seriously consider what happens if the subsidies stop when the federal government can no longer manage its $35 trillion national debt. How will these new corporate socialists compete in a world where the subsidies have shielded them from real-world competition for decades? Do any of them even care about the United States, or is it only about the money the CEOs receive while they help drain the treasury of the United States to fatten their bonuses?

The Rise of New Socialists in the Age of Gilded Subsidies (Part 1)