Alex DeGrasse: Three In Five Americans Now Know Inflation Is Getting Worse In The US

According to data released last week, the quarter between April 1 and June 30 was the second consecutive one in which U.S. GDP declined; two consecutive quarters of decline is considered by some economists to be the “textbook definition” of a recession. Despite that, some economists say that the strong job market is a sign that the U.S. economy is doing well, and the Federal Reserve has said that the U.S. is not in a recession.

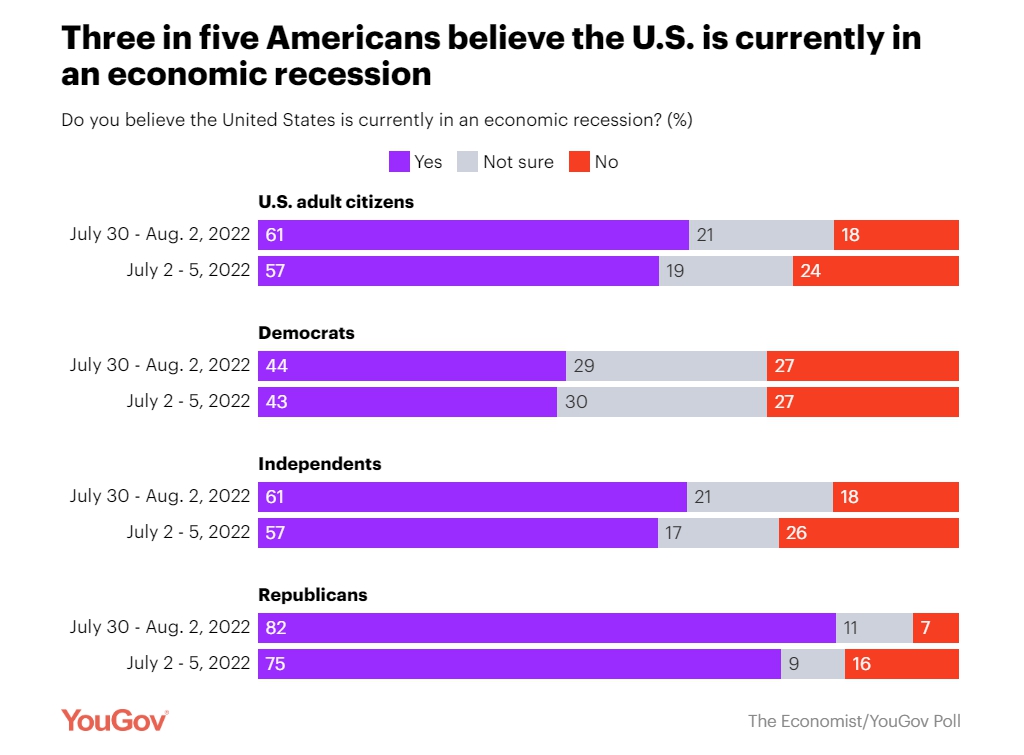

According to the latest Economist/YouGov poll, the share of Americans seeing the U.S. as being in a recession is up slightly to 61%, from 57% at the beginning of July. Despite the small change over a few weeks, what has remained constant is that a majority of Americans perceive that the country is in an economic recession. Asked in an open-ended question why they believe the U.S. is in a recession, many people cite the two consecutive quarters of negative growth. Others talk about rising prices and challenges in buying basic items.

Among the 18% of Americans who say the U.S. is not currently in a recession, most (55% of the group) say it is very or somewhat likely that there will be an economic recession during the next 12 months. Among Americans overall, just 4% say both that the U.S. is not currently in a recession and that a recession is not very likely or not at all likely to happen in the next year.

A possible reason for the perceptions and concerns about a recession: Most Americans (56%) say they have felt the impact of inflation “a lot” in their own lives. People with a family income of less than $50,000 are more likely to have felt the impact of inflation (61%) than are people with an income between $50,000 and $100,000 (56%) or more than $100,000 (49%). In order to save money, 72% of Americans say that this year they have put off buying at least one of the following: clothing or personal items (48% say this), going on a vacation or taking time off (46%), doing home repairs or maintenance (34%), doing car repairs or maintenance (25%), and/or receiving medical care (22%).

Majorities of Americans have had at least a “somewhat difficult” time paying for gas (65%), food (58%), and housing (53%), with nearly as many affected by car payments (47%); 77% have had difficulty paying for at least one of these. While gas is difficult to afford for nearly two-thirds of the public, affording gas is challenging for especially large shares of people with a family income under $50,000 annually (73%) and people living in a rural community (74%).

By Kathy Frankovic and Linley Sanders

Read Full Article on Today.YouGov.com