The Federal Reserve is not expected to cut interest rates until June.

President Donald Trump renewed his call for the Federal Reserve to cut interest rates, saying Fed Chair Jerome Powell’s “termination cannot come fast enough.”

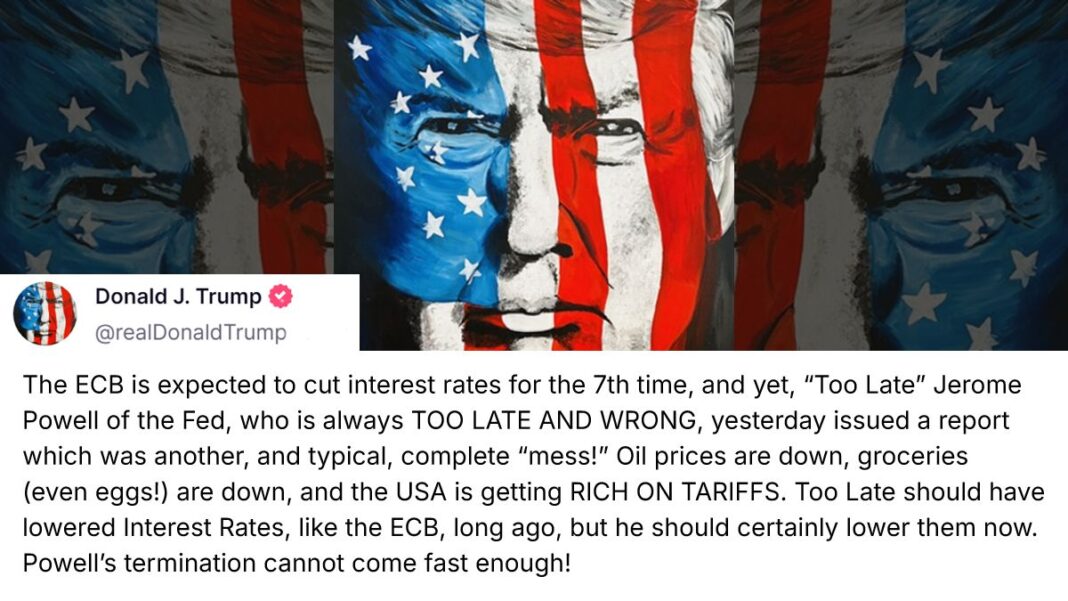

In a Truth Social post on April 17, Trump urged the Federal Reserve to emulate the European Central Bank (ECB) and follow through on rate cuts as prices are down and “the USA is getting rich on tariffs.”

“Jerome Powell of the Fed, who is always TOO LATE AND WRONG, yesterday issued a report which was another, and typical, complete ‘mess!’” Trump said. “Powell’s termination cannot come fast enough.”

At the April policy meeting, the ECB announced another quarter-point interest-rate cut, the seventh reduction since June 2024. The institution has attempted to bolster the bloc’s growth prospects and cushion potential tariff-driven economic blows.

This month, Trump has revived his critical comments against Powell.

Trump wrote in an April 4 Truth Social post that it would be “a perfect time for Fed Chairman Jerome Powell to cut interest rates.”

“He is always ‘late,’ but he could now change his image, and quickly,” Trump said. “Cut interest rates, Jerome, and stop playing politics!”

Powell said on April 16 that the new administration is engaging in “very fundamental policy changes” that could put the central bank in uncharted waters. While Powell stopped short of referencing stagflation, the Fed chief noted that the larger-than-expected sweeping tariffs could boost inflation and slow growth.

This, Powell says, would put the Fed in a dilemma between supporting the economy and tackling inflation.

“If that were to occur, we would consider how far the economy is from each goal, and the potentially different time horizons over which those respective gaps would be anticipated to close,” he stated at an event hosted by the Economic Club of Chicago.

However, since monetary policy is in a good position, Powell believes he and his colleagues can wait for greater clarity before taking action.

The Fed chair’s speech and follow-up question-and-answer session triggered a selloff in the financial markets.

By Andrew Moran