The incoming administration is faced with consumers who are struggling with high debt, high interest rates, and wages that haven’t kept up with inflation.

Inflation was the chief issue for millions of Americans going into the 2024 election.

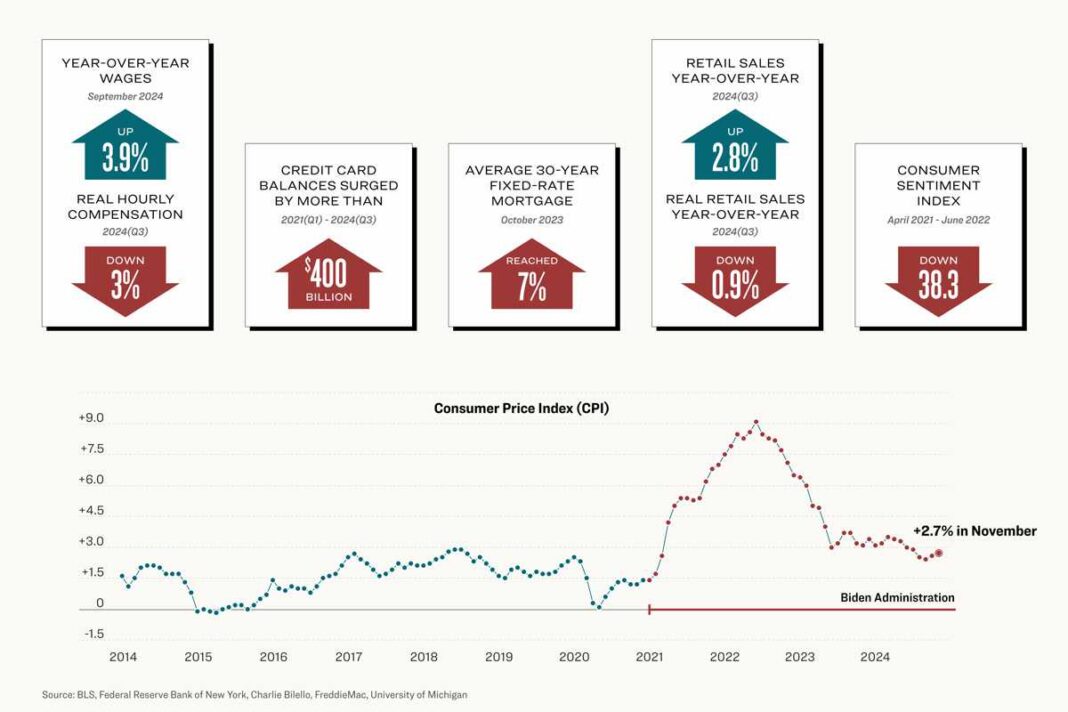

When President Donald Trump left office in January 2021, the annual inflation rate was 1.4 percent. When he returns to the White House next month, the consumer price index (CPI) will be roughly double, at close to 3 percent.

Consumer inflation has surged 21 percent on a cumulative basis since January 2021. Many goods and services have increased at a higher level over the last few years, be it electricity (28 percent) or bread (25 percent).

Treasury Secretary Janet Yellen doesn’t expect prices to drop to pre-pandemic levels.

“I don’t expect the level of prices to go down. Some prices will be higher than they were before the pandemic and will stay higher,” she said in an exchange with Sen. John Kennedy (R-La.) in February.

This cumulative inflation effect, especially in such a short timeframe, has weighed on businesses and households in various ways.

Wages

Nominal (non-inflation-adjusted) wage growth has soared about 20 percent, and the November jobs report highlighted that wages are still rising at a year-over-year pace of 4 percent.

While wages have been rising faster than inflation since May 2023, they have not fully caught up to inflation. When workers’ earnings are adjusted for inflation, they have yet to return to their pre-January 2021 levels.

Real (inflation-adjusted) hourly compensation is still down nearly 3 percent. Median weekly real earnings have dipped to about 0.5 percent.

The latest Bureau of Labor Statistics numbers show mixed results. Last month, real average hourly earnings remained unchanged, while real average weekly earnings jumped by 0.3 percent.

According to Bankrate’s 2024 Wage to Inflation Index, wage growth is on track to recover from inflation by the second quarter of 2025.

Earlier this month, a separate Bankrate survey found that 61 percent of workers have received a pay increase in the 12 months since October 2023. At the same time, 59 percent say their earnings have not kept up with rising household expenses.