Trump unveiled the External Revenue Service to shift tax burdens from Americans to foreign trade partners through tariffs and duties.

President-elect Donald Trump has unveiled plans to create the External Revenue Service (ERS), a new agency modeled after the IRS but aimed at collecting tariffs, duties, and revenues from foreign countries rather than U.S. taxpayers.

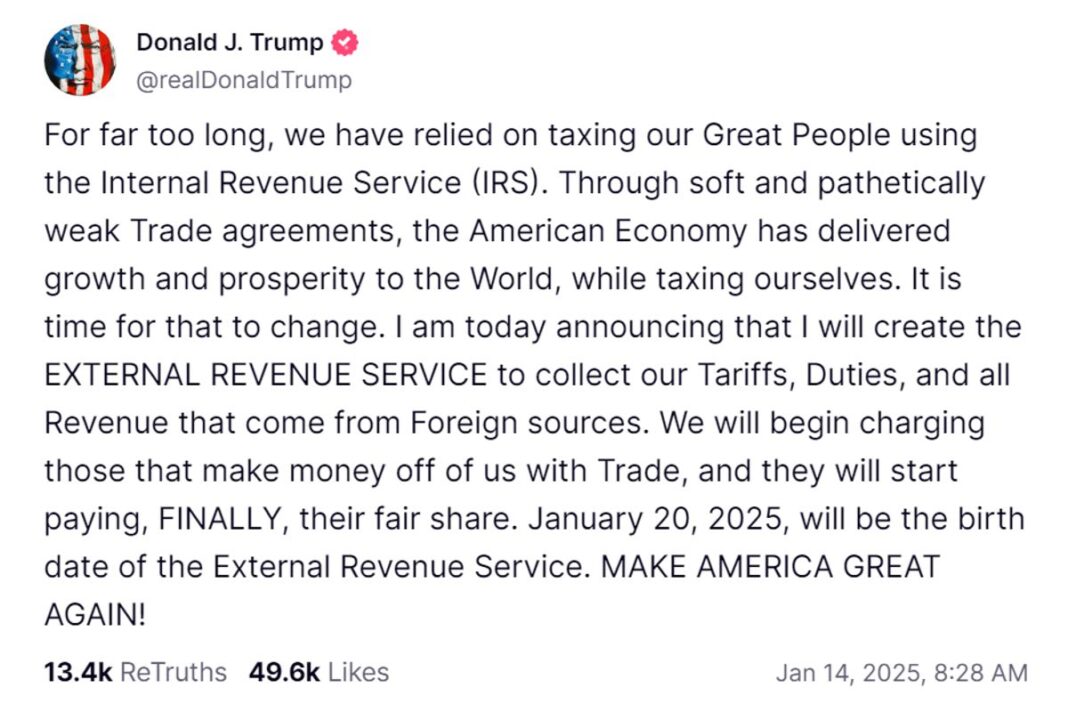

Trump announced the plan in a Jan. 14 post on social media, in which he framed the proposal as a move to shift the financial burden of taxation away from U.S. citizens and onto foreign entities benefiting from trade with the United States.

“For far too long, we have relied on taxing our Great People using the Internal Revenue Service (IRS),” he wrote. “Through soft and pathetically weak Trade agreements, the American Economy has delivered growth and prosperity to the World, while taxing ourselves. It is time for that to change.”

Trump has consistently criticized what he sees as unfair trade agreements crafted by past leaders, arguing that these deals disproportionately benefit foreign partners while disadvantaging the United States. He has also expressed deep concern over the nation’s trade deficit, which totaled $773.4 billion in 2023, including both goods and services. Pointing to this massive trade imbalance, Trump has defended his calls for broad tariffs on imports as a necessary step to address what he describes as a long-standing injustice sapping America’s economic strength.

Trump said the ERS will launch on Jan. 20, his first day in office. The agency is to focus on revenue generation from foreign sources by enforcing tariffs, duties, and other trade-related fees on goods imported into the United States. The idea appears to be to shift some of the responsibility for funding the government away from domestic taxpayers and toward foreign nations and corporations benefiting from access to the U.S. market.“We will begin charging those that make money off of us with Trade,” Trump said. “They will start paying, FINALLY, their fair share.”

Customs and Border Protection (CBP), which resides within the Department of Homeland Security, collects tariffs from U.S. importers, not foreign countries or companies that export products. The importers pay the tax to the CBP.