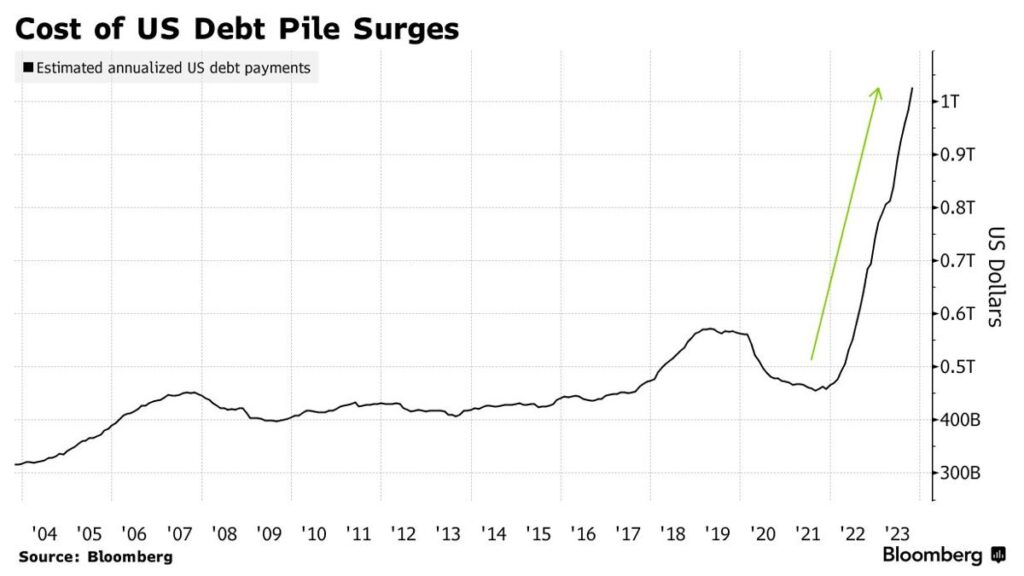

- Amount of annual interest payments has doubled in 19 months

- Rise in issuance from 2020 will also need to be refinanced: BI

US Treasuries may face renewed selling pressure into the new year if the nation’s swelling debt repayment bill is any guide.

Estimated annualized interest payments on the US government debt pile climbed past $1 trillion at the end of last month, Bloomberg analysis shows. That amount has doubled in the past 19 months, and is equivalent to 15.9% of the entire Federal budget for fiscal year 2022.

The figures are calculated using US Treasury data which state the government’s monthly outstanding debt balances and the average interest it pays.

The worsening metrics may reignite debate about the US fiscal path amid heavy borrowing from Washington. That dynamic has already helped drive up bond yields, threaten the return of the so-called bond vigilantes and led Fitch Ratings to downgrade US government debt in August.

“There will be further increases to Treasury coupon auctions and T-bills outstanding going forward,” Bloomberg Intelligence strategists Ira Jersey and Will Hoffman wrote in a research note. “Besides deficits of over $2 trillion in the foreseeable future, climbing maturities following the increase of issuance from March 2020 will also need to be refinanced.”

By Ruth Carson and Mark Cudmore