Factory activity improved in April while price pressures and uncertainty related to the Trump administration’s trade policies weigh on the outlook.

U.S. manufacturing showed modest but meaningful signs of improvement in April, according to data released Wednesday by S&P Global, which showed factory output and new orders ticking higher.

The April 23 report, combined with Federal Reserve data, suggests America’s industrial sector is stabilizing amid tariff-related uncertainties.

The S&P Global Flash U.S. Manufacturing PMI rose to 50.7 in April from 50.2 in March, marking a two-month high and remaining just above the neutral 50 threshold that separates expansion from contraction.

Factory output also returned to growth, edging up to 50.2 from a contractionary reading of 48.6 in the prior month. The improvement, though modest, points to a sector that is adapting to volatile conditions while benefiting from stronger domestic demand.

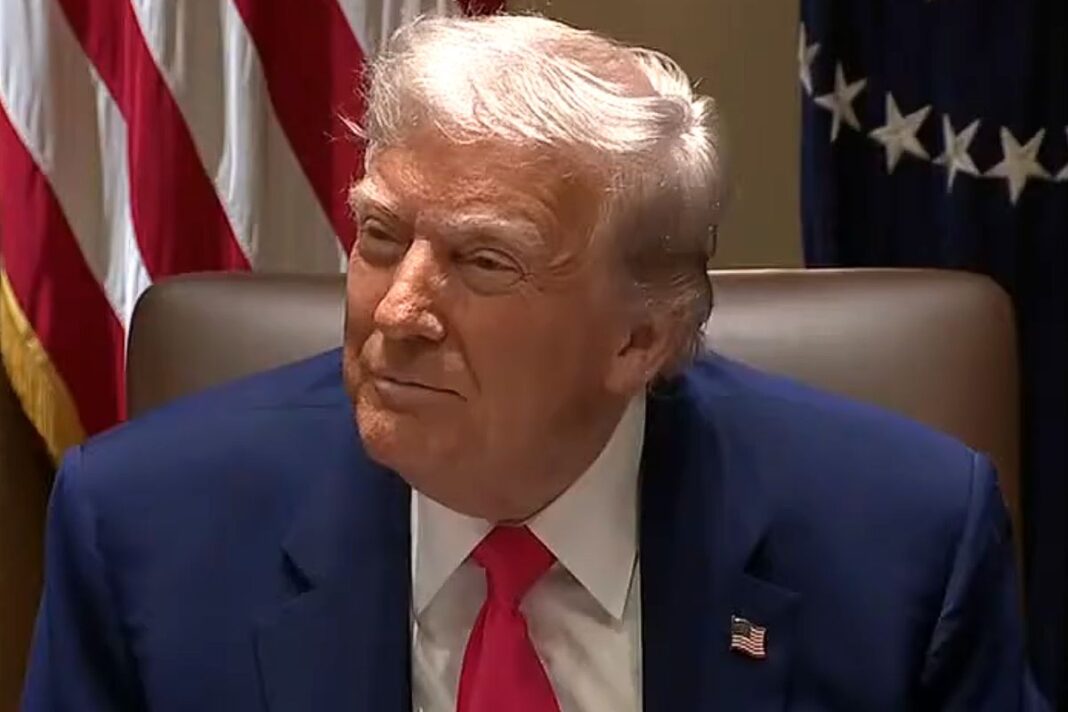

The data comes as the Trump administration continues to implement sweeping tariffs as part of a broader effort to revive America’s long-declining industrial base. President Donald Trump’s trade strategy aims to close trade deficits, encourage the reshoring of U.S. production, and fund tax cuts through increased tariff revenue. While the policy has rattled markets, it has also begun to alter sourcing decisions and drive some gains in domestic manufacturing.

“While tariffs had in some instances reportedly helped drive new sales to domestic customers, trade policy was widely linked to falling foreign sales,” the S&P Global report states, noting that the overall uptick in factory orders was constrained by a drop in export orders.

Inventories held steady, and longer delivery times for manufactured products were once again reported—a sign typically associated with busier supply chains. However, factory employment fell for the first time since October, signaling caution on labor investment.

Business sentiment, meanwhile, continued to deteriorate. According to S&P Global, manufacturers’ confidence in future output fell to its lowest level since last August, reflecting concerns about higher input costs, supply disruptions, and weakening export demand. Still, some manufacturers expressed optimism about the long-term benefits of trade protectionism.

The somewhat brighter manufacturing picture in the S&P Global report was generally reinforced by the Federal Reserve’s latest Beige Book.

By Tom Ozimek