The White House on Thursday announced that Democrats had reached a deal on the broad strokes of their multi-trillion budget reconciliation bill, resolving months of infighting among the Democratic caucus in Congress.

To appease Sens. Joe Manchin (D-W. Va.) and Kyrsten Sinema (D-Ariz.), the bill’s price tag has been slashed in half from an original top-line price of $3.5 trillion down to a top-line price of $1.75 trillion.

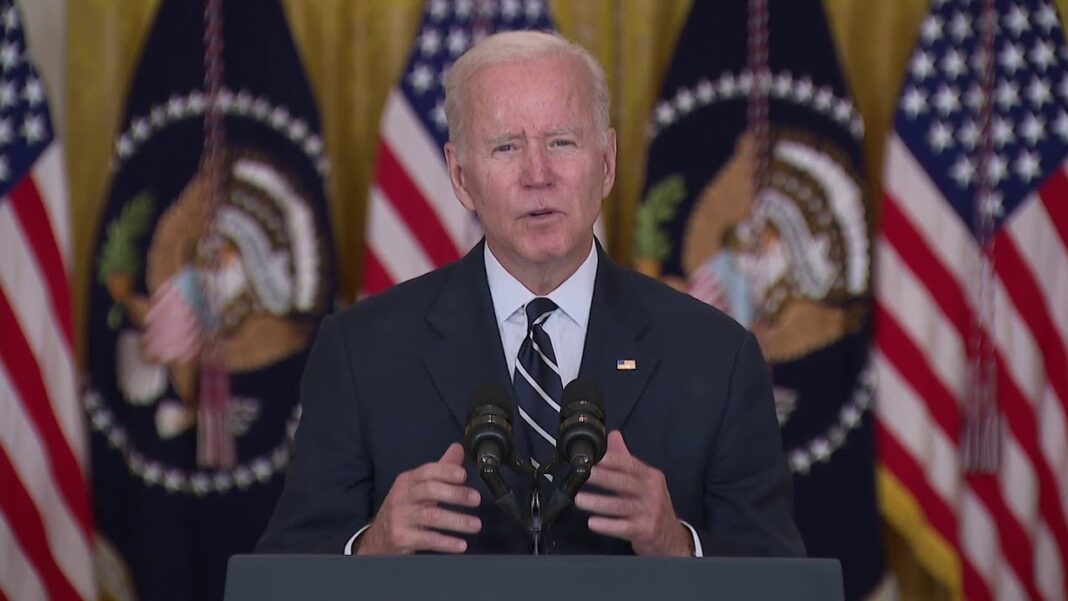

“After hearing input from all sides and negotiating in good faith with Senators Manchin and Sinema, Congressional Leadership, and a broad swath of Members of Congress, President Biden is announcing a framework for the Build Back Better Act,” announced President Joe Biden in an online press release.

Manchin and Sinema have long held up the legislation, citing concerns over the bill’s price and its potential to cause unintended collateral damage, to the chagrin of progressive Democrats.

Since the bill’s inception, Manchin, Sinema, and others have spoken against the laundry list of proposals from their party: incentives for clean energy, encouraging electric vehicles, carbon taxes, expansion of the government’s role in health care, increasing tax rates, and a measure to let the IRS snoop into Americans’ bank accounts, among others.

These squabbles pushed the bill far off schedule, but the new agreement gives a glimmer of hope to supporters of the bill.

In his release, Biden touched on the main highlights of the new, smaller bill.

The bill’s broad expenditures are: $400 billion for child care and preschool programs, $150 billion for home health care, $200 billion for child and earned income tax credits, $555 billion for “clean energy and climate investments,” $130 billion to expand President Barack Obama’s Affordable Care Act (Obamacare), $35 billion for hearing benefits for those on Medicare, $150 billion for housing initiatives, $40 billion for higher education and workforce development programs, $100 billion for immigration, and $90 billion for “equity and other investments.”

In order to meet their promise to craft a fully paid-for bill, the budget will also include a long list of new revenue schemes. According to the White House release, these new revenue schemes include estimated revenue of: $325 billion from a 15 percent minimum corporate tax, $125 billion from a new “stock buyback tax,” $350 billion from “Corporate International Reform to Stop Rewarding Companies That Ship Jobs and Profits Overseas,” $230 billion from Democrats’ new “billionaire tax,” $250 billion from “closing [the] Medicare tax loophole for [the] wealthy,” and $400 billion from new “IRS investments,” among others.

By Joseph Lord

Read Full Article on TheEpochTimes.com