Many Americans have shifted their savings goals from long-term dreams to simply having a rainy day fund.

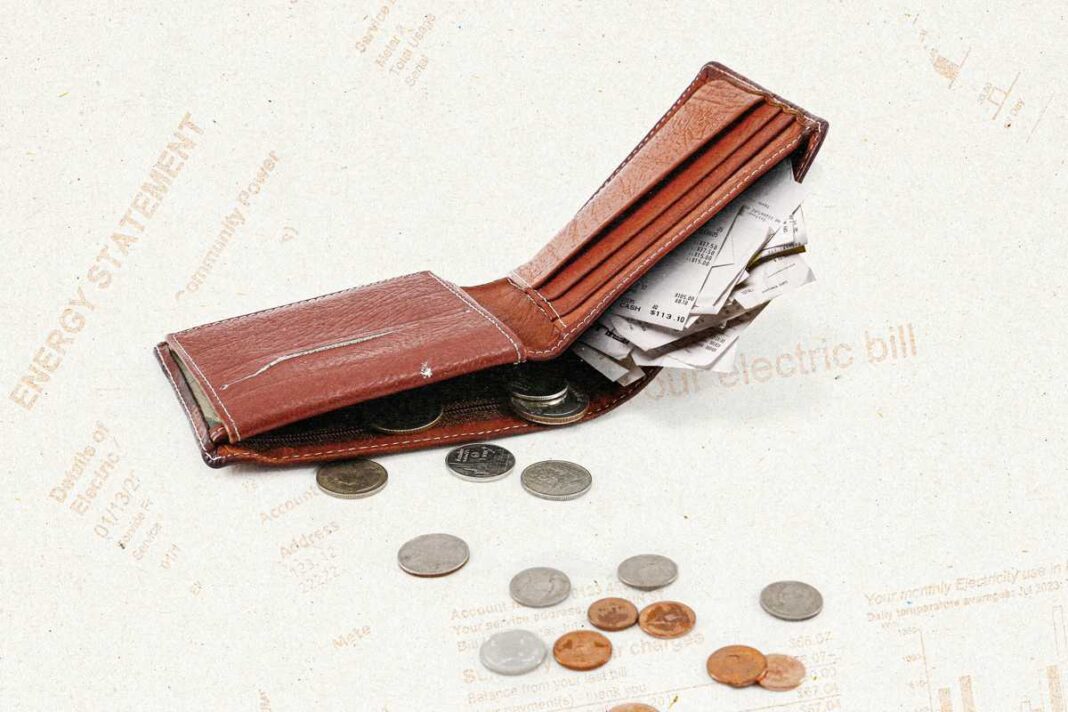

Reduced inflation and wage increases haven’t stemmed the economic struggles of middle-class Americans. In fact, some middle-income earners say it’s harder than ever to put money away in savings.

Many ascribe this to stagnant wages and higher prices for things like gas, groceries, and utilities that began in 2021 and persist to this day.

The United States hit a 41-year inflation high in 2022, which is when residents saw historic price hikes. In 2022, the consumer price index soared by more than 9 percent, according to the Bureau of Labor Statistics.

“Our research shows mathematically that the overwhelming driver of that burst of inflation in 2022 was federal spending, not the supply chain,” Mark Kritzman, a senior lecturer at the Massachusetts Institute of Technology’s Sloan School of Management, wrote in an article.

Two years later, inflation has fallen to 2.6 percent, but Americans aren’t seeing price adjustments in areas like grocery stores, housing costs, utility bills, and insurance.

Mary Lopez, a marketing manager and middle-income earner at Trusted Wedding Gown Preservation, a New Jersey-based business, said wage stagnation and a higher cost of living across the board has made it hard to save money and maintain a middle-class lifestyle.

“In terms of significant changes, my household, like many others, has felt the impact in areas like health care and housing,” Lopez told The Epoch Times via email.

“For instance, the rate of health insurance has spiraled upward and we’ve faced hikes in rent consistently. Many of my peers cite similar experiences, struggling to save amid these increasing costs.”

The median home price in September 2024 was just over $400,000. This represents the highest September median the National Association of Realtors has ever recorded and is $20,000 shy of the all time high, according to a Bankrate analysis. The rental markets haven’t fared any better, with asking prices more than 33 percent higher than before the pandemic.

The average premium for single coverage health care increased by 6 percent this year and family premiums rose 7 percent.